Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

The Driver of Returns – Installment I

Overview

Beyond the cashflow or earnings performance of an individual firm, the next driver for nearly all investments are prevailing interest rates. However, not all investors seriously consider where rates are going and what is driving them.

The purpose of this installment is to share our observations and hopefully increase understanding. To do so, we are breaking up this report into a Bull Case, Mixed Case, and Bear Case.

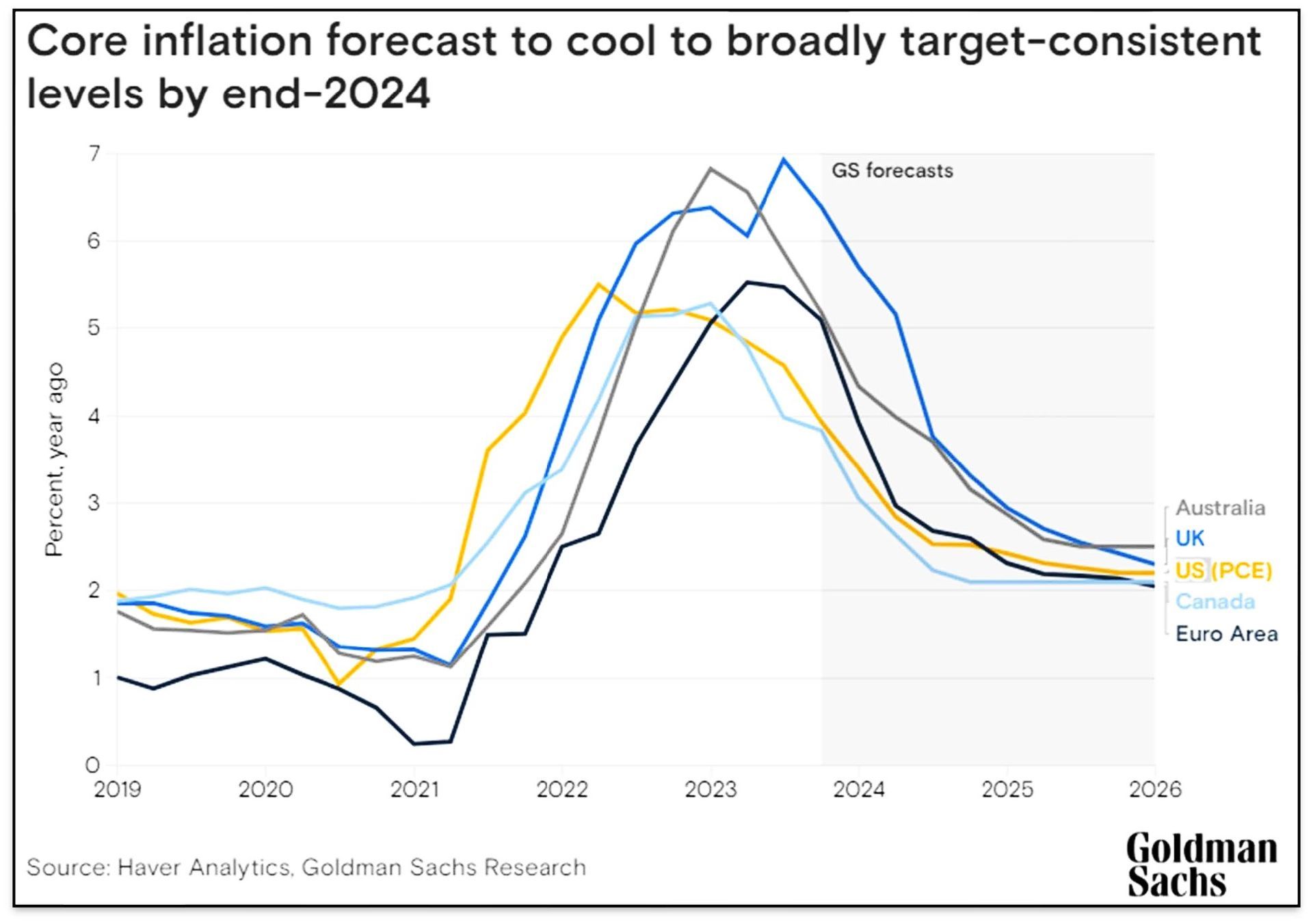

Figure I: Core Inflation Expected to Align with Targets by Late 2024

Bull Case

To examine the interest rate Bull Case (i.e., that interest rates will decline), we turn to a long-time giant in the field: Lacey Hunt of Hoisington Asset Management¹. Mr. Hunt believes that interest rates will decrease and has positioned his portfolio accordingly: the duration of his portfolio is 18 years. The underlying basis for such a movement is:

The money supply is declining, as measured by Other Deposits Liabilities (ODL). ODL is M2 excluding paper currency or retail money market funds. Paper currency is accepted in fewer business establishments. Monetary deceleration leads to lower interest rates unless the velocity of money increases, which for the most part, it has not.

High US Fiscal Deficits – near 6% of GDP will slow growth and result in deflation.

High Federal Debt – more cash will be allocated to interest payments thereby impeding growth.

Weak Demographics – reduced birth rates will hinder growth.

Mr. Hunt believes the yield curve will normalize, but the most attractive trade is long-term treasuries. Gary Shilling (of Gary Shilling & Co.)² is also in the bull camp, believing inflation will reduce, and economic growth will slow, and Treasury values will rise (with the decline in interest rates).

Mixed Case

Jeffery Gundlach of Double Line³ believes the economy will soften and interest rates will decline in the short run. However, over the medium term, Mr. Gundlach suggests rates might rise due to the massive federal fiscal deficits and sovereign debt. As support, he suggests that 5 years from now, 50% of tax receipts will be needed to pay Federal interest expense. While it is easy to buy short-term treasuries (“T Bill and chill”), Mr. Gundlach is more comfortable with 5-year Treasuries at 5%, which in his opinion provides less reinvestment risk.

Bear Case

The clearest proponent of the bear case is Stanley Druckenmiller of Duquesne Capital⁴. For the past decade he has focused on the need for federal budget rectitude and now is more concerned than ever. He expects the US government to face pressure to refinance its debt in the next couple of years and struggle with increased interest costs. Mr. Druckenmiller expects the yield curve to normalize (i.e., for short term rates to decline relative to long term rates) but is also bearish on long treasuries.

Synthesis

We will provide our own view (and the basis for such view) in our next installment.

Sources

[1] https://www.youtube.com/watch?v=t0M6Nkd94Ks

https://www.youtube.com/watch?v=bzBGXF0t02k

[2] https://www.youtube.com/watch?v=f8_R6EBozX8

[3] https://www.youtube.com/watch?v=5xzFzSKvFO4

[4] https://www.youtube.com/watch?v=dmrrt7aCXhY

Contact Us

sales@ejproxy.com

(646) 883-9898

1120 Avenue of the Americas

4th Floor

New York, NY 10036