Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Family Feud at Lifeway Foods

Ludmila Smolyansky and Edward Smolyansky have filed a consent solicitation at Lifeway Foods, Inc. seeking to replace all seven directors on the board with themselves and five other nominees. The current CEO and chair of the board is Julie Smolyansky – Ludmila’s daughter and Edward’s sister.

After evaluating the details of the consent solicitation and the current financials of the company, we recommend shareholders vote AGAINST all proposals in the consent solicitation for the following key reasons:

- The financials of the company indicate it is healthy and growing.

- Shareholder returns in recent periods have exceeded those of the total market.

- The dissidents present no clear alternative strategy or vision for the company.

Background

Lifeway Foods, Inc. specializes in cultured dairy products and is especially known for its Kefir milk product. The company was founded in 1986 by Michael Smolyansky and his wife, Ludmila Smolyansky. After Michael Smolyansky passed away in 2002, their daughter Julie Smolyansky took over as CEO. Their son Edward Smolyansky served as COO until 2022. In 2024, Edward Smolyansky started his own kefir company, Pure Culture Organics, a direct competitor of Lifeway Foods.

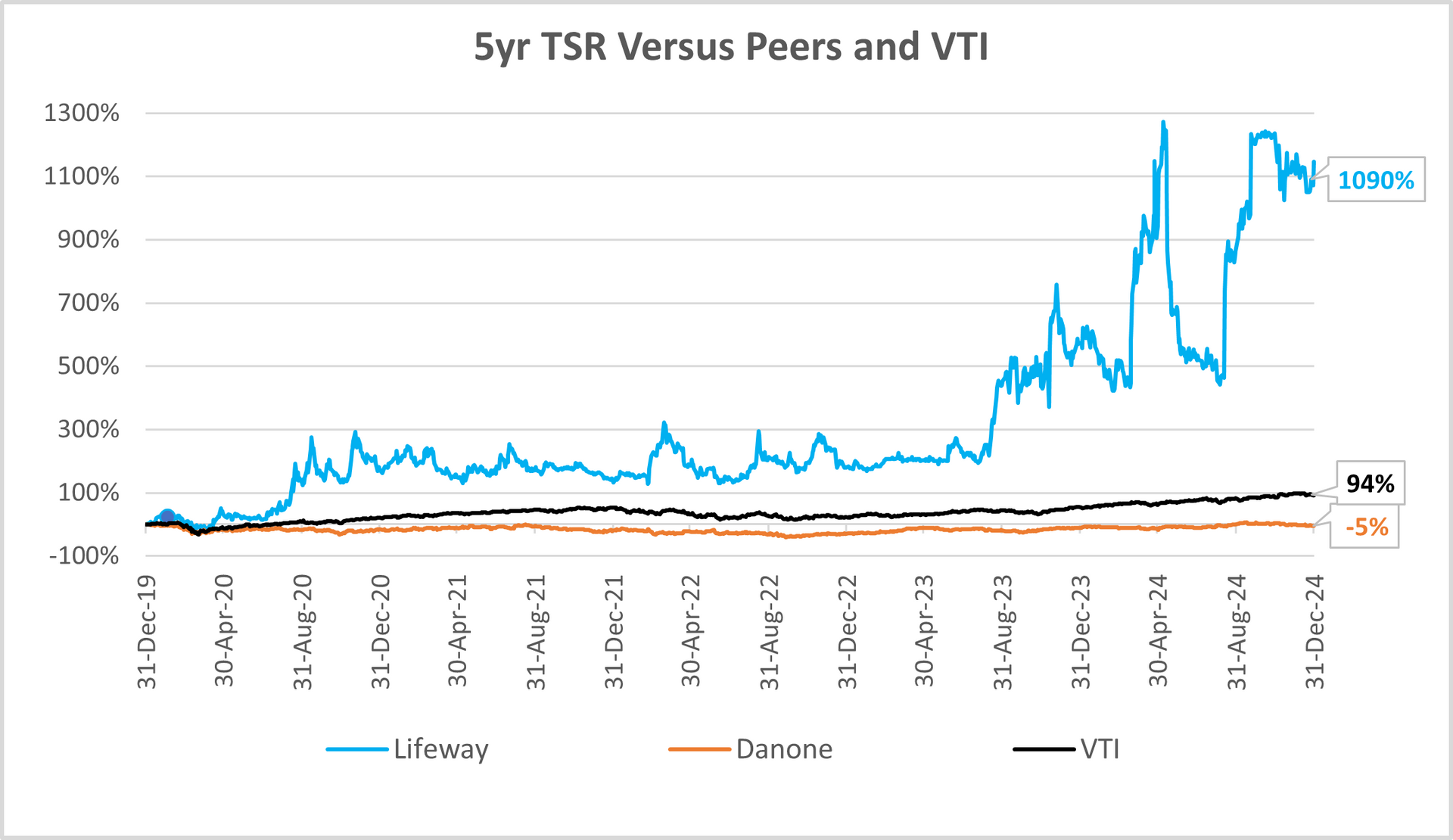

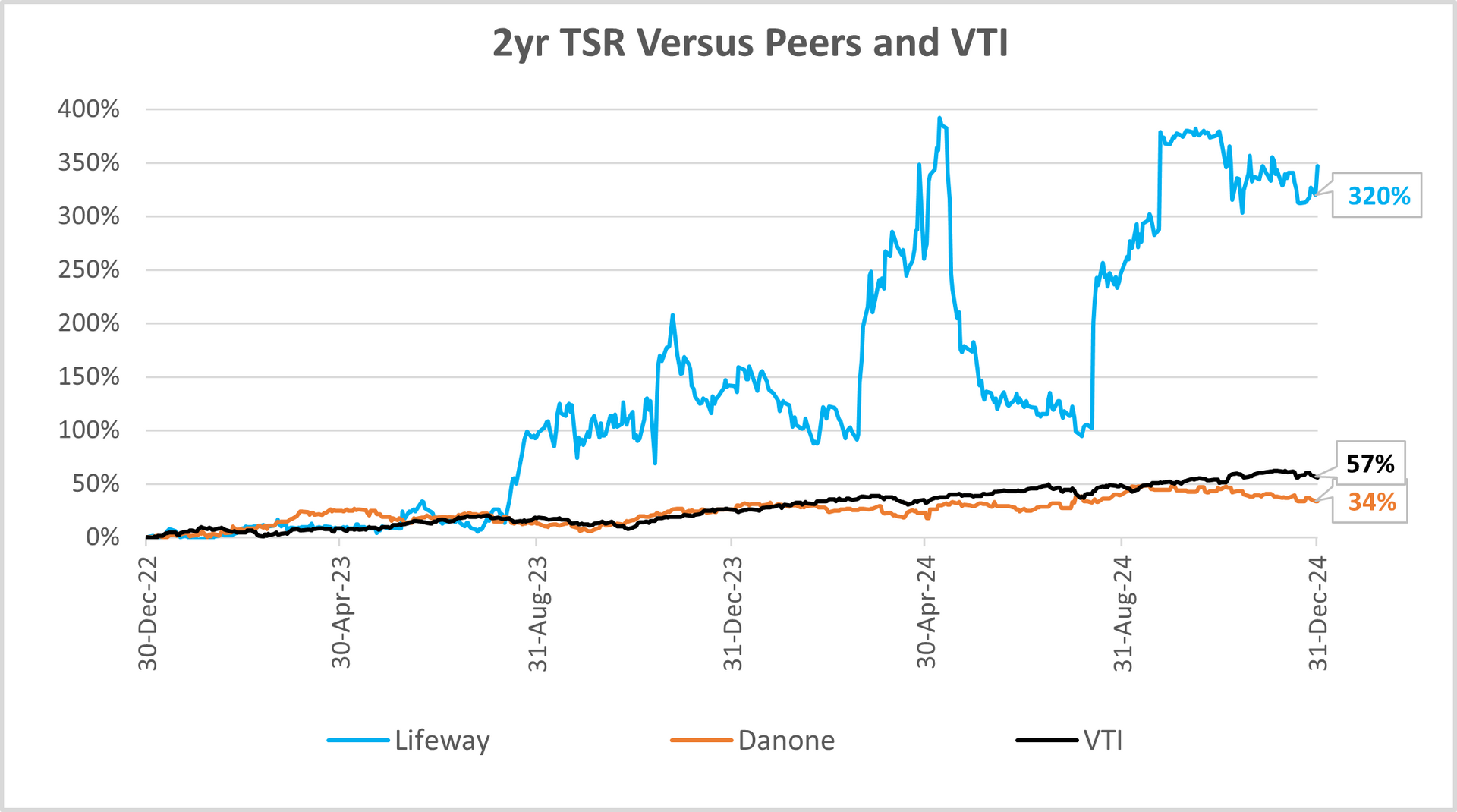

Shareholder Returns

Since the duty of a public corporation is to maximize returns for its owners, the main measure of its success is total shareholder return (TSR). We looked at the 5yr and 2yr TSR for Lifeway compared to the total market (VTI) and to Danone, a French company known for its similar product offerings (such as yogurts and fermented dairy products). As shown in the charts below, despite recent volatility, Lifeway has significantly outperformed Danone and VTI in both periods.

Financials

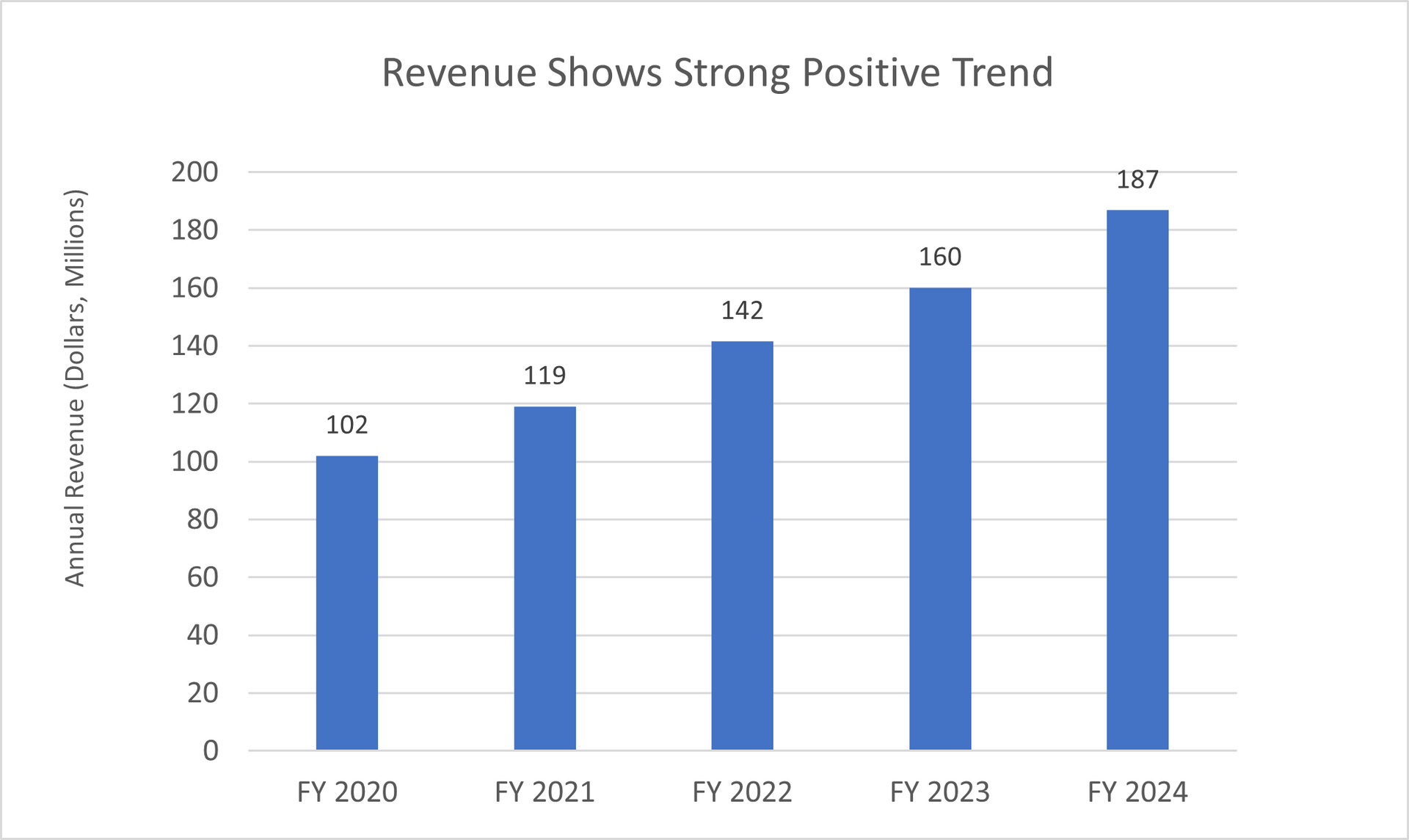

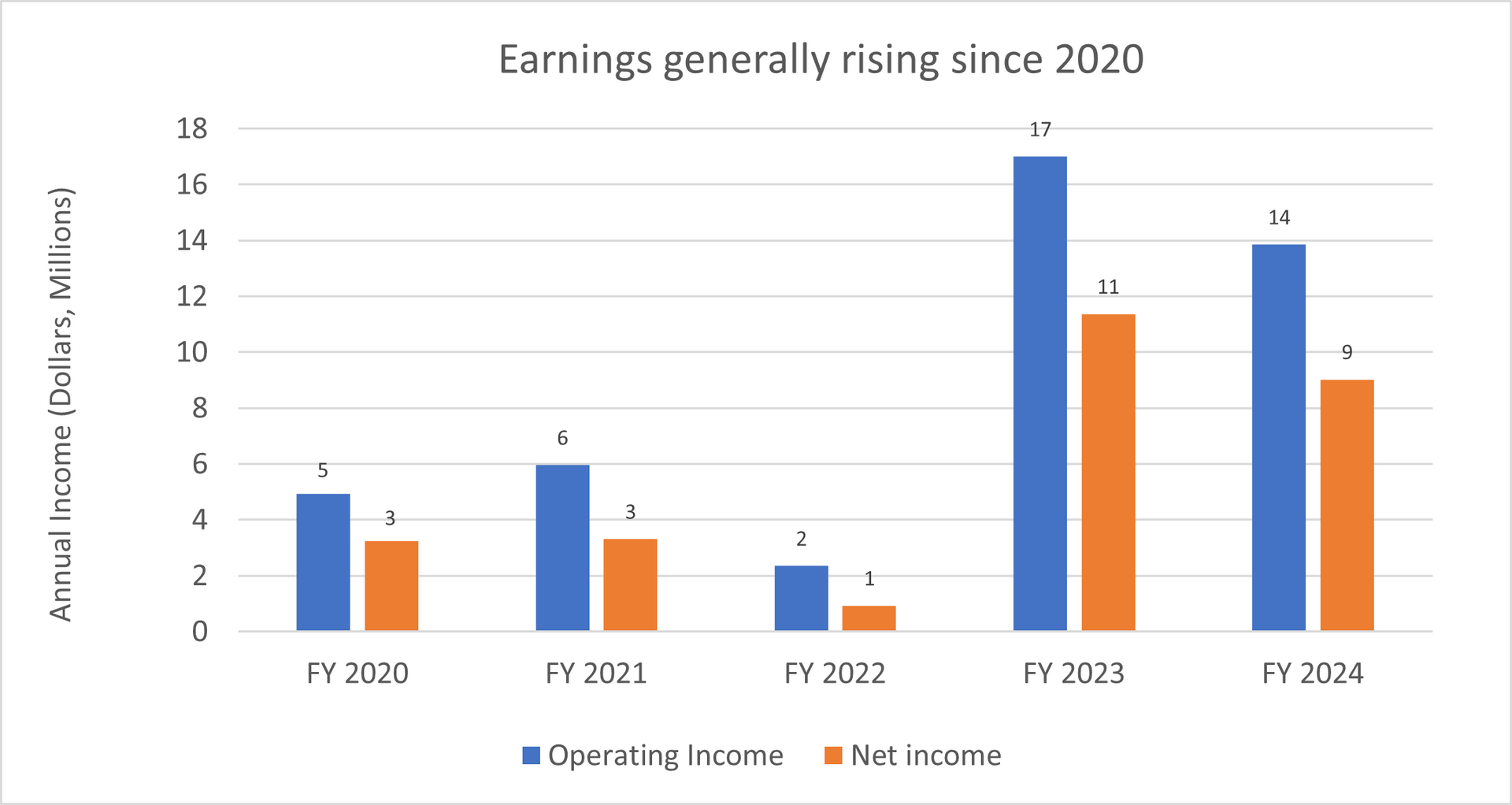

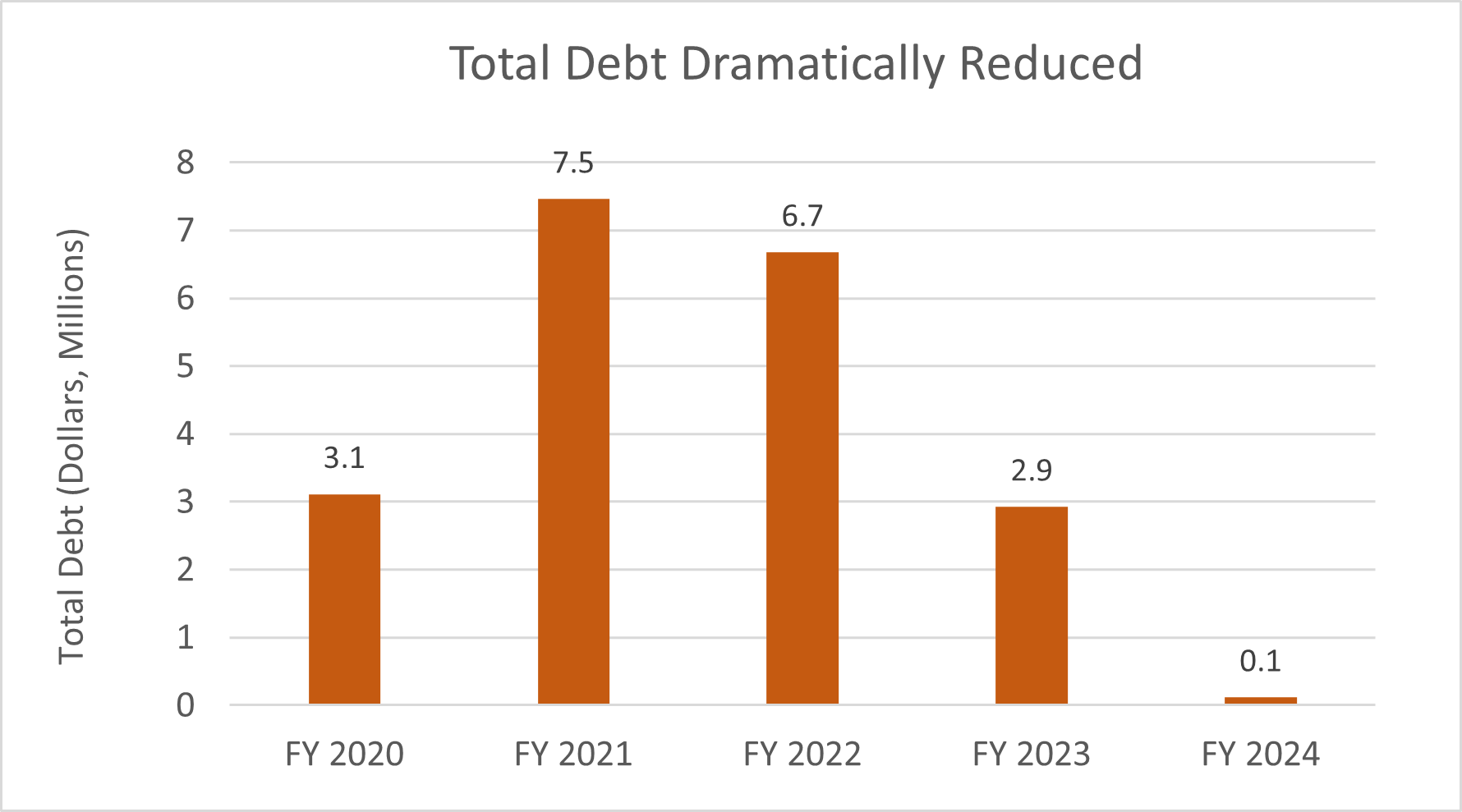

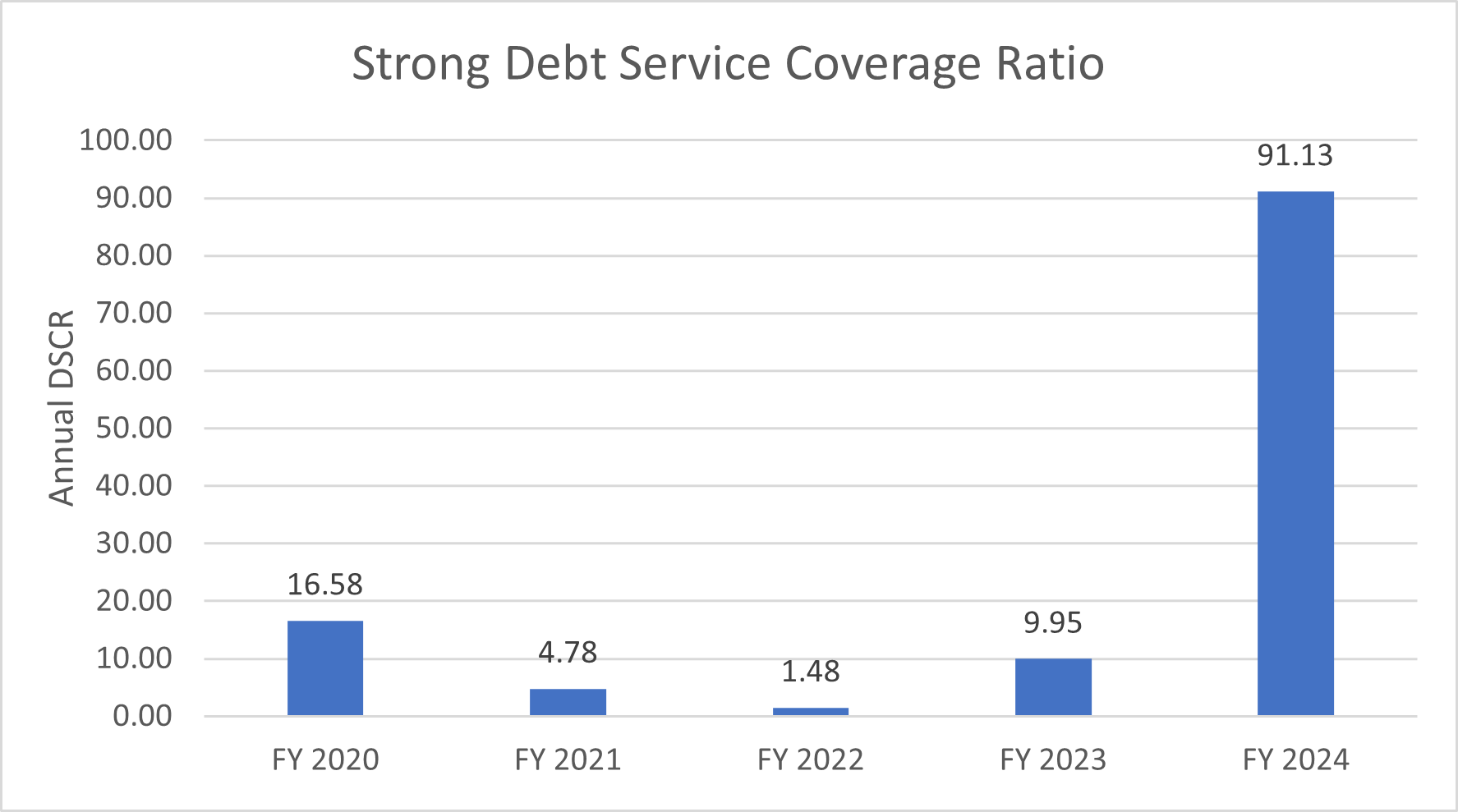

Lifeway’s financials also suggest that the firm is a healthy, growing business. The revenue has been increasing year-over-year since 2020, although earnings dropped from 2023 to 2024. Additionally, the company holds very little debt.

Taken together, these metrics indicate a company that is growing and maintains great operational flexibility due to its low leverage.

Conclusion

Although our analysis considered other factors—such as Danone’s unsolicited acquisition proposals and governance concerns regarding nepotism—the dissidents do not present a compelling case for change or an alternative strategy. Additionally, the company is financially strong and is significantly outperforming the total market. We therefore recommend AGAINST all proposals at this consent solicitation.

Egan-Jones provides best-in-class, independent, and unconflicted research to issue vote recommendations that are in the best interests of shareholders. Schedule a meeting here to find out more → schedule a meeting