Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Breaking Bad; Accidents Waiting to Happen

Overview

One of the most difficult, yet critical tasks for sophisticated institutional investors and risk managers is anticipating major market moves and hopefully adjusting portfolios for such moves. This installment will address some areas that we believe need attention. (This commentary was written by individuals outside the Ratings team.)

Historical Perspective: Good Ideas Gone Bad

Collapses often occur when a kernel of a good idea goes bad. For example, while few remember, railroads were a tremendous innovation which connected isolated communities with markets, thereby enhancing welfare for many. However, what is forgotten is the fact that many railroads failed over time because of the massive upfront capital investment needed before service could begin. By November 1873, 55 US railroads had failed. Another 60 were bankrupt by September 1874.

Even after establishment, running a railroad could be challenging, as evidenced by the bankruptcy of Penn Century, in June 1970, the largest bankruptcy at the time.

Unfortunately, automobiles followed a similar pattern where a development with terrific promise translated into joy for some and tears for many. In addition to the forgotten brands of Hudson, Studebaker, and the recent failure of some EV makers such as Fisker and Nikola, there were the often-forgotten filings of GM and Chrysler in 2009. Surprisingly to us (because of the numbers), Wikipedia lists hundreds of defunct automobile manufacturers in the United States. Below is a truncated listing of those beginning with the letter “A”:

- Automobile Company (1910–1913)

- AC Propulsion (1997–2003)

- Apex Motor Car Company (1920–1922)

- Acme Motor Car Company (1903–1911)

- Adams Company (1905–1912)

- Anger Engineering Company (1913–1915) - (also known as A.E.C.)

- Aerocar Company (1905–1908)

- Aerocar International (1946–1987)

- Aircraft Products (1947)

- Airway (1949–1950)

- Ajax Motors Co. (1914–1915)

- Ajax Motor Vehicle Company (1901–1903)

- Aland Motor Car Company (1916–1917)

- Albany Automobile Company (1907–1908)

Current Candidates

On to some current candidates.

Case 1

““AI is a much bigger deal than the Industrial Revolution, electricity and everything that’s come before,” Ellison told former U.K. Prime Minister Tony Blair in an interview at the World Governments Summit in Dubai in February.” (WSJ)

Following the pattern of promising technologies attracting massive capital with only a few winners, we are concerned about the capital being poured into Artificial Intelligence (AI). There is little doubt that the technology will be of great value; our concern is one of scale and future efficiencies.

On the first point, with approximately $250 billion corporate investment in 2024 and much higher amounts in 2025, even if there are no advancements in terms of efficiencies (which is doubtful), will there be sufficient payoff to justify the investments?

Assuming a 12+% return is probably a reasonable hurdle rate for capital investments in nascent markets, will the market pay approximately $30 billion per annum for 2024’s investments in the technology? Current revenues, not income, for market leader OpenAI is merely $10B and its losses are near $8B.

Regarding the second point on efficiency, we expect that more efficient ways for deriving AI generated solutions will continue to develop. Perhaps DeepSeek can be explained away, but our expectation is that there will be a raft of other developments which meet the normal “FBC” (Faster, Better, Cheaper) requirement.

Lastly, there is the structural change whereby to compete, it is not sufficient to have a better algorithm, but rather it needs to be coupled with other features to be useful to the bulk of the market. For example, one needs a delivery mechanism such as Google, or robot offerings, or autonomous vehicles.

If our concern is well-placed, the impacted areas obviously extend beyond the frontline AI firms.

Case 2

Since earlier we referenced the automobile industry, (which is massively important because of its size and scope), perhaps a revisit is warranted. The major challenge facing the legacy auto companies is the increasing acceptance and the increasing production from the electric vehicle (EV) auto manufacturers. A 20% increase in production from relatively new entrants is a massive blow to the traditional producers and we expect the EV production volumes will continue to grow.

Self-driving vehicles have already become ubiquitous in some American cities. As of June, Waymo (a subsidiary of Alphabet) has driven a total of 30 million miles in San Francisco and 46 million miles in Phoenix. Most users appear to prefer Waymo to sitting in a cab with a stranger. Per mile driven, Waymo has had 91% fewer serious injury or worse crashes.

Of course, Tesla appears to have some significant advantages. Their cheaper hardware array and massive vehicle fleet will make deployment of the technology easier than it will be for Waymo, which partners with other manufacturers.

Both affordable EVs and self-driving technology put massive pressure on incumbent manufacturers. For example, after announcing a $45 billion plan to invest in EVs in 2023, Mercedes has decided to stop selling EVs in the United States.

Case 3

This case involves a rarity in modern times and if it happens (hopefully it will not), it might constitute a wake-up call for many. Before diving into the specifics, it is worthwhile revisiting the premise behind the repayment of debt.

Typically, underwriters count on a continuation of current events, that is the ability to generate cash to meet obligations remains intact and that those obligations do not grow materially relative to cash flow and collateral. Unfortunately, this equation appears to no longer fit.

Japan

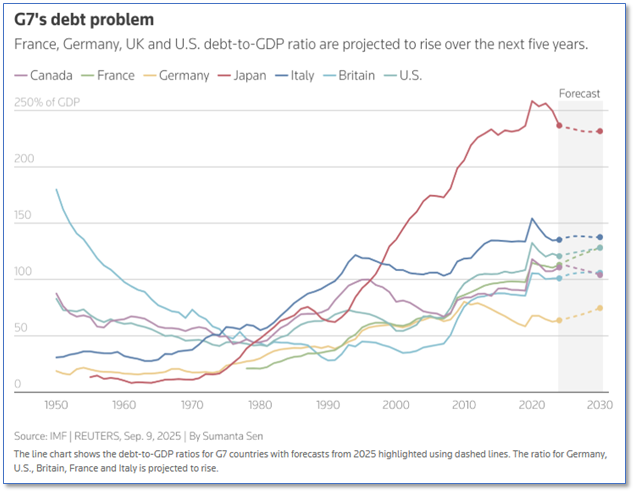

Since the Second World War, Japan experienced the equivalent of an economic miracle by rapidly establishing itself in a variety of primarily export-oriented businesses (autos, consumer electronics, shipbuilding, etc.). However, of late, increased deficit spending, rise in interest rates, troublesome demographics/ increased dependency ratio, and increased defense spending requirements are turning that miracle into something very different. As shown in the above chart, Japan leads the G7 in debt-to-GDP, which is not a problem, until it is. In particular, the need for outside capital and the rise in interest rates might be the catalysts for broader concerns.

Offsets: A possible response to the increase in funding costs is the Bank of Japan (BOJ) resuming its substantial purchases. Of course, there is no “free lunch,” as the BOJ’s intervention is likely to place additional pressure on currency values.

Paths Forward: Since Japan remains a linchpin for the West, it would not be a surprise if the country receives some support from Western countries, although such support is unlikely to address underlying problems.

France

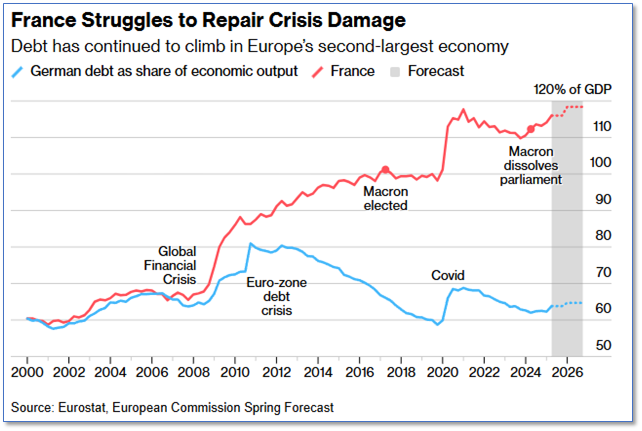

France’s political morass continues, with little progress in sight:

“Prime Minister François Bayrou submitted his resignation Tuesday after losing a crushing confidence vote in parliament. The third toppling of a head of government in 14 months leaves President Emmanuel Macron scrambling for a successor and a nation caught in a cycle of collapse.” (PBS)

As usual, it is about the money; France is under pressure to cut its deficit, which is currently running at 5.8% of GDP, while it is also pressured to increase defense spending, currently near 2.0%. Since voters are not willing to make the sacrifices, the response is political turmoil.

Offsets: The European Central Bank, under Mario Draghi, was committed to doing whatever it took to reduce spreads for Italy during the financial crisis:

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” (ECB)

Therefore, we expect the ECB will come to France’s rescue in the short run.

Paths Forward: While ECB support helps in the short run with the cost and availability of funding, if the underlying problems remain, the country, its businesses, and its citizens will suffer.

Conclusion

Financial collapses are always obvious after the fact. Hopefully a little foresight will be helpful.