Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Delaware Exit: A Case Study of Dillard’s

Key Takeaway: Suffering from Success

Dillard’s recent move to reincorporate in Texas from Delaware (“Dexit”) reflects a broader trend of companies seeking more permissive governance frameworks. Dillard’s governance practices often diverge from what some consider “best practice,” yet the firm has achieved remarkable equity returns for shareholders. Dillard’s success provides a challenge to those who claim governance “best practices” are required for strong equity returns.

Background

On August 19th, shareholders of Dillard’s voted to approve the reincorporation of the company from Delaware into Texas. The proposal passed with approximately 90% approval. A handful of other companies have already reincorporated into Texas (including SpaceX and Tesla in 2024), are considering moving (such as Meta), or have reincorporated into other states (e.g., Dropbox, TripAdvisor, AMC Networks).

This trend is largely attributed to recent management-unfriendly rulings from the Delaware court (such as striking down Mr. Musk’s infamous Tesla pay package) and more favorable corporate laws in Texas that offer stronger protection for boards by raising thresholds for shareholder litigation.

Reasons for Reincorporation

Dillard’s, in its proxy statement, has specifically cited the litigious environment in Delaware as a key reason for its proposal to reincorporate. They claim Texas affords greater protection to management from “opportunistic and frivolous litigation.” They have also cited Texas’ statute-focused approach to corporate law as opposed to Delaware’s case-law based approach as providing more predictability.

Additionally, Dillard’s claims that the rights afforded to shareholders in Texas will be comparable to those offered in Delaware. They also cite Texas as a key operational center, with more revenue derived from Texas than any other state.

Governance

Many have criticized efforts to reincorporate from Delaware into Texas, Nevada, and other states, which some claim are shareholder-unfriendly, as the corporate laws tend to favor issuers. Thus, Dillard’s proposal to reincorporate into Texas is just one of several governance decisions that deviate from governance “best practices.”

Dillard’s currently has a dual-class capital structure where their class A common stock is publicly traded on the NYSE and one share equals one vote. The class B common stock is not publicly traded and is held almost entirely by W.D. Company (an entity controlled by the Dillard family). While both the class A and class B common stock grant one vote per share, class B shareholders elect 10 out of the 15 Dillard’s board members, while the class A holders elect only 5 out of 15 directors. This gives the Dillard family control of most board members.

As a result, many members of the Dillard family sit on the board, and have served for many years, including William Dillard II, William Dillard III, Michael Dillard, Denise Mahaffy, and Drue Matheny. The average tenure on the board is approximately 24 years and only two of the 15 directors are female. Finally, Factset’s Truvalue ESG rating of the company places them in only the 6th percentile.

Dillard’s Performance

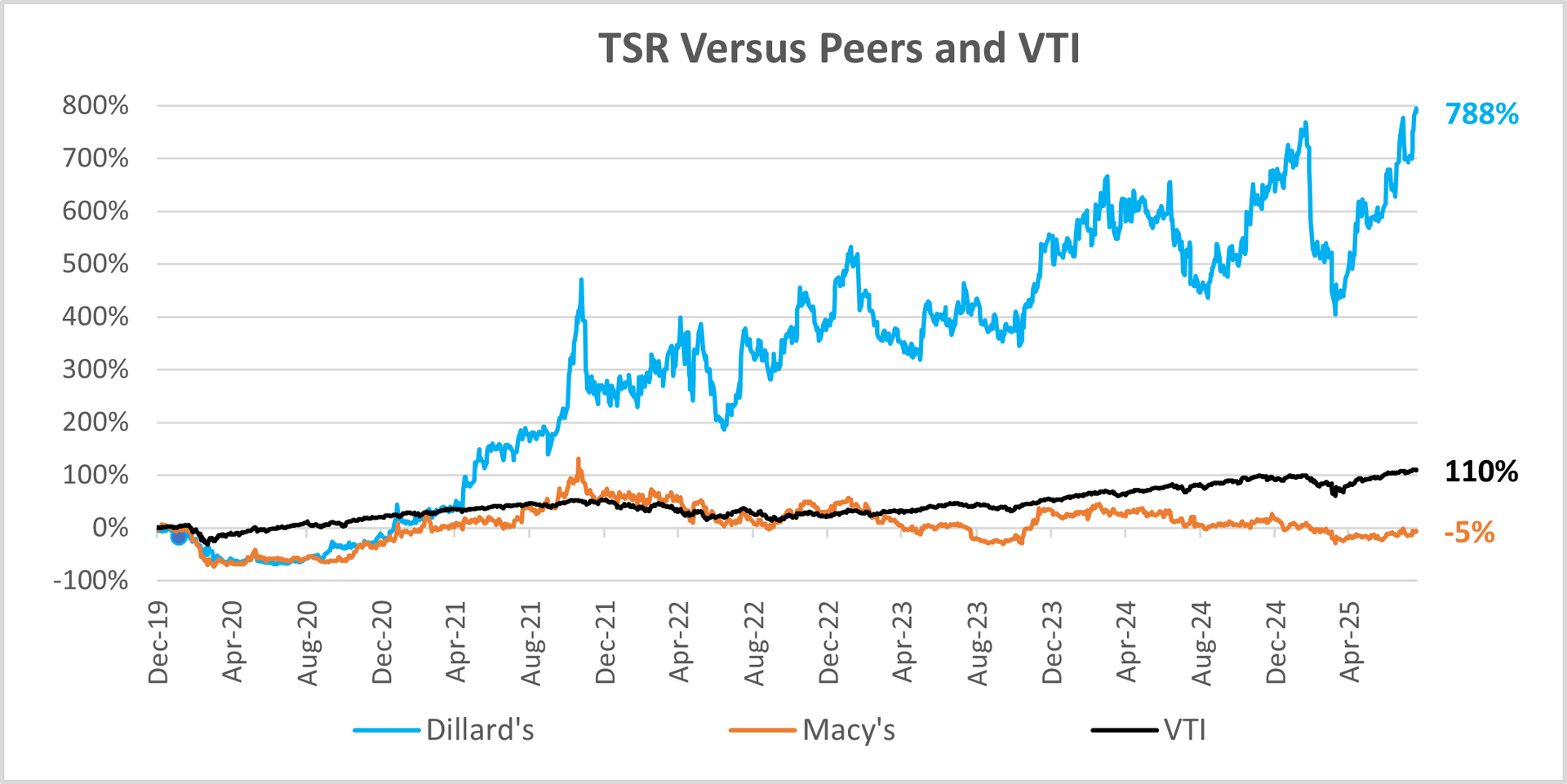

Despite these significant governance concerns, Dillard’s has performed well. In recent years, brick-and-mortar retailers have struggled to compete with their online counterparts, particularly in the value segment. Key competitors include Amazon and more recently Shein and Temu.

Nordstrom famously went private in May of 2025 after years of underperformance and declining share prices. Macy’s hit its peak in 2015 at almost $70 per share, but the share price has since fallen to approximately $12.

In contrast to this, Dillard’s total shareholder return (TSR) has topped 700% since the beginning of 2020 (pre-pandemic). This is largely due to significant share buybacks and dividend payouts to shareholders. Over the past year, Dillard’s paid 25-cent quarterly dividends, along with a substantial special dividend of $25 paid in January 2025.

These share buybacks and dividend payments demonstrate the company’s commitment to generating returns for its shareholders, which is the ultimate duty of any public company.

Conclusion

Dillard’s decision to reincorporate in Texas highlights a growing trend of companies seeking legal environments that offer greater managerial flexibility. While its governance practices diverge from what many consider “best practices,” the company’s strong performance complicates the narrative.

Despite entrenched family control, long board tenures, and other departures from “best practices,” Dillard’s has delivered market-leading returns and significant capital to shareholders. This raises a provocative question: can unconventional governance structures and moves, such as reincorporating in Texas still serve shareholder interests effectively?