Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Bending Minds, not Metal; the New Path Forward

Overview

The current administration is focused on returning manufacturing jobs to American soil. Our thesis is that traditional manufacturing certainly has a place but that a better goal might be high-tech, higher value-add endeavors, particularly those where the country has a competitive advantage.

Figure I: Ukrainian “Sea Baby” Boat Drone

A Changing Economy

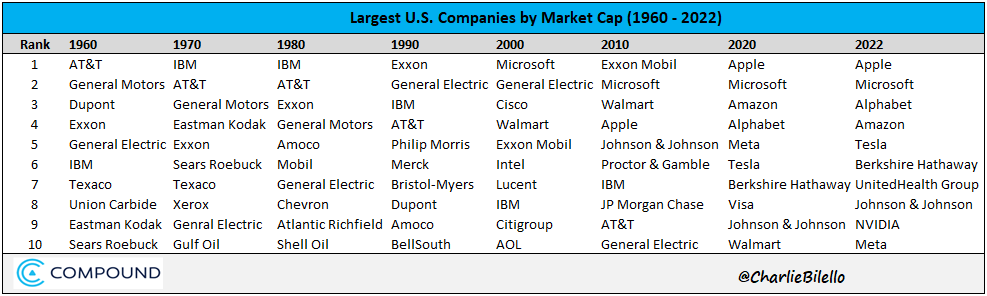

The traditional “Blue Chip” firms of the 1940s and 1950s have been eclipsed by a panoply of tech-focused firms that have created massive wealth for investors, customers, and partners.

AT&T, ITT, GM, and US Steel are still relevant, though to a far lesser degree. In their place are Alphabet, Amazon, Apple, Meta, NVIDIA, SpaceX, and a panoply of emerging firms, many of which did not exist ten years ago.

The New Economy

Just as wealth creation shifted from farms to factories during the industrial revolution, our view is that the trend is continuing whereby traditional manufacturing adds far less value today than it did 50 years ago.

Warfare Parallel

Perhaps this shift is best demonstrated in life and death circumstances. In modern warfare, the traditional tools and methods are proving woefully obsolete. Look no further than Ukraine where relatively inexpensive “Sea Baby” marine drones (see the image at the top) are defeating massively expensive warships. Similarly, $500 drones are easily destroying multimillion-dollar tanks, helicopters, and other specialized equipment.

Accelerating Differences

While it is somewhat nostalgic to think of the relatively high-paying jobs of factory assembly workers, as time passes, those jobs are likely to become scarcer as robots assume a greater portion of the repetitive manual tasks. Advances in AI and robotics are progressing faster than previously thought possible.

A Better Approach & An Essential “Pivot”

Assuming our thesis is directionally correct, and it is only a matter of time before machines assume the bulk of repetitive manufacturing, what is the best approach? We believe in focusing on areas which have the potential to yield long-term returns.

One way of viewing the wealth and strength of a country is to compare the market capitalization of companies domiciled in the country versus its peers. The notion is that the country can extract resources from the companies to defend its borders. Using this measure, perhaps it makes the most sense to encourage a robust environment for the development of such companies. Perhaps this is the “miracle” of the free markets, that is the allocation of resources to those firms and enterprises that can make best use of those resources. For the most part, the system has worked.

Promising Areas

Now for the hard part of identifying future winners and losers. While it is something we think about daily, perhaps the below listing might be useful for identifying promising areas over the next five years:

Space Travel – the ability to quickly and easily access space is becoming increasingly important for communications, defense, and possibly natural resource extraction (see Helium-3 mining from the moon for use in nuclear fusion)

Chip Development and Manufacturing – for the past several decades, this area has been critical and remains so.

Data and Communications Infrastructure – since AWS’s emergence as an acceptable means for processing and storing data, all related areas will likely experience continued robust growth.

Robotics, AI, and Drones – it is just a matter of time before “machines” undertake a significant portion of manual tasks.

Airframe Manufacturing – Boeing’s problems underscore the need for alternatives in this duopoly industry.

Home Manufacturing – 3D printing homes presents a much faster and more affordable alternative to existing construction methods.

New Energy – advancements in fusion, geothermal, and solar provide hope for cheaper, low-carbon sources in our future.

Concerning Areas

This also is hard, but our basic premise is that some areas might face weak demand relative to supply growth.

Petroleum and Natural Gas Production – demand for these energy sources is likely to wane on a relative basis over time.

Legacy Auto Firms – better manufacturing techniques and more efficient propulsion systems threaten traditional manufacturers.

Financial Services – social platforms have the potential to disintermediate traditional providers via their extensive reach, and consumer-accepted technology. Furthermore, the current administration appears to be more receptive to alternatives. Watch moves in this area from Amazon, Meta, and X.

Metal Benders – firms in this area will increasingly become commoditized via smart manufacturing. A friendly manufacturing environment will be critical to success.

Conclusion

Our premise is that the economy has massively changed over the past few decades and the administration would be better served by focusing on the environment that allows future leaders to thrive.