Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Boxed In; Addressing Slippage in Sovereign Credit Quality

Overview

History was made when one of the last legacy rating firms cut their rating on the United States debt from “Aaa” to “Aa1”. In the minds of many senior analysts, the move was overdue. Perhaps the more relevant question is whether the action will be followed in coming years.er value-add endeavors, particularly those where the country has a competitive advantage.

“Free Money”

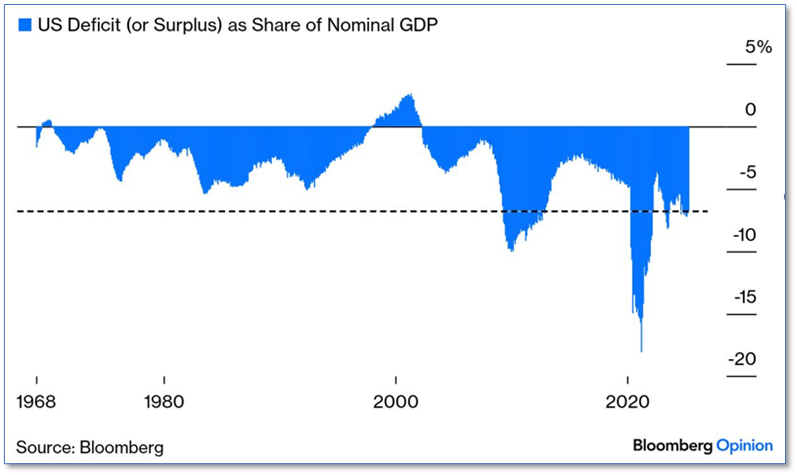

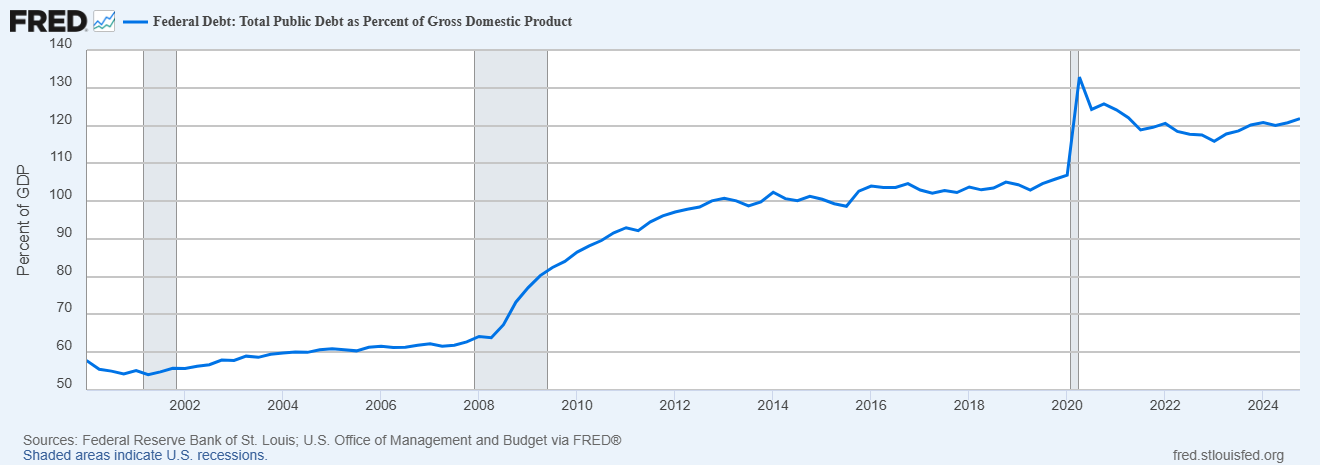

A typical measure for sovereign credit quality is the level of debt to GDP. When a government runs a deficit, its debt is growing, particularly when the deficit exceeds GDP. As can be seen from the above chart, this condition was especially prevalent during the 2021 Covid scare, when the deficit hit approximately 18% of GDP. While memories may be short, the government gave out money to many taxpayers and businesses in an effort to help them weather the Covid storm. Perhaps some inspiration came from Former Fed Chairperson Bernanke, who described dropping cash out of helicopters to stoke demand (hence the term “helicopter Ben”).

The Upshot

Mr. Bernanke’s approach worked – perhaps too well – as people spent the proceeds and stoked inflation. Additionally, many left the work force as the government checks were close to what they could earn from working. However, the subsequent major problem was the rise in government debt relative to GDP.

The Challenge

For his second term, Mr. Trump campaigned on a restoration of the country’s status, including a significant cut in government spending. While headlines were made about excess expenditures and potential fraud, in many cases resolution appears to be stymied by the courts. As we speak, arguments are being heard regarding the extent of the Executive Branch’s authority relative to the Judicial branch. While the new administration is likely to be successful in making some cuts, the issue is whether those cuts will be sufficient.

Third Rail

The “third rail” (i.e., the taboo subject) is a cutting of the social service payments such as Social Security, Medicaid, and Medicare. However, if public estimates are to be believed, Social Security will run out of funds by 2037. Additionally, as expected, the Affordable Care Act (Obamacare) is proving to be far more expensive ($398 bn in 2024) than original estimates.

Fork in the Road

To date, the current administration has focused on the non-entitlement areas (i.e., those areas of government spending other than Social Security, Medicare, Medicaid, and Obamacare). Additionally, it has installed policies which hopefully will enhance GDP, thereby increasing the denominator in the sovereign debt measure. However, such actions might not be enough to reverse the prior deficit spending. With narrow control in the House and the Senate filibuster rules, it is questionable that any major structural change can be made. Furthermore, we doubt the recent downgrade will provide an impetus for major cuts.

Conclusion

While many will bemoan the loss of the country’s top credit rating, the reality is that it has been in the works for some time. The bigger issue is whether the country takes actions to improve or remains on its current path.