Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Careening Out of Control: Harley-Davidson Looses Support of Egan-Jones

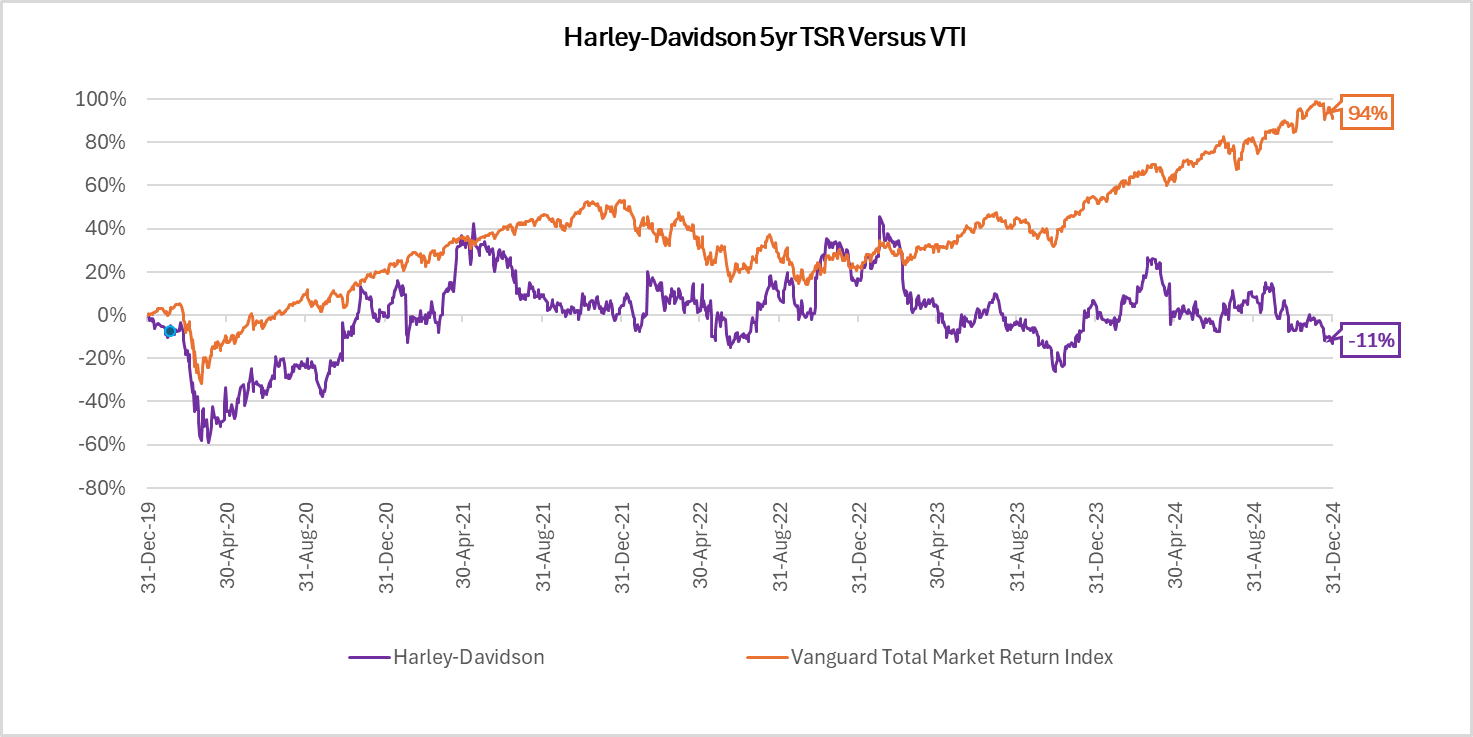

Over the past five years, Harley-Davidson (NYSE:HOG) has yielded -11% returns for investors as compared to the total market returning 94% (see figure I). Once an American classic, Harley-Davidson has increasingly lost relevance to American and foreign consumers. The fundamental question for shareholders is whether HOG’s management is best suited for protecting and enhancing value or whether a change is in order.

Under its Wealth-Focused Policy, Egan-Jones recommends shareholders vote WITHHOLD for Harley-Davidson directors Zeitz, Levinson, and Linebarger.

Figure I: Total Shareholder Return for HOG and Vanguard Total Stock Market Index (5yr)

Reasons for poor performance

We have identified the below reasons for HOG’s poor performance.

Aging riders and low market growth

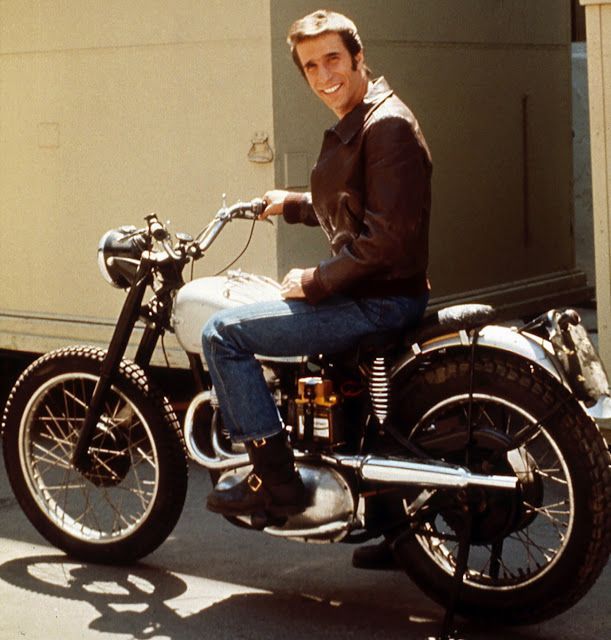

Perhaps best represented by The Fonz, played by Henry Winkler, in the show Happy Days, a motorcycle was once synonymous with being cool. When the show concluded in 1984, the median age of a motorcycle owner in the United States was about 27.¹ However, by 2018 the median age had doubled to about 50.² Put simply, younger people aren’t buying motorcycles.

While older riders have more available funds than younger ones, their shorter lifespans and greater risk aversion pose serious challenges for HOG. The result has been hardly 10% growth in registered motorcycles in the US since 2019.³

The Fonz on His Iconic Harley-Davidson Knucklehead

Increased foreign competition

As occurred in the car market, Japanese manufacturers have provided a credible alternative to American manufacturers and now collectively control the majority of the American motorcycle market. While Harley-Davidson maintains some cachet among older consumers, the result has been an 18% decline in nominal revenue since 2006 and 11% in nominal revenue since 2023.⁴

For a business with high operational leverage (meaning the marginal cost of material and labor to produce an additional motorcycle is low), profit will decline significantly given a small change in revenue. Total annual operating income decreased 47% between 2023 and 2024 to $417 million.

Absence in growing markets

While Harley leads the US market with ~30% market share, the U.S. is only the 11th largest motorcycle market. Globally, the market for motorcycles is growing at about 8.4% per year, mainly in China and India where the product mix leans toward lighter vehicles. In 2021, Harley only accounted for about 9% of global sales.⁵

Inability to transition to electric

A recurring trend is the inability of incumbents to transition to new technology due to the new supply chain, expertise, and mindset required to be successful in the new area. Once successful carriage companies failed to transition to motorized transport, and we are seeing the same with the transition to electric vehicles.

Those markets which are growing quickest have a strong and growing appetite for electric vehicles. 50% of motorcycles sold in China in 2024 were electric. In 2023, HOG sold a paltry 660 electric motorcycles through its LiveWire brand.⁶

Missing on other thrills

While younger consumers haven’t sought to emulate The Fonz as their fathers did, they have turned to other thrills for transportation. Electric bicycles and monowheels have offered an affordable transportation alternative that can be ridden places unavailable to motorcycles. Further, they don’t often require a license or registration. Harley has entirely missed this market segment.

The Market’s Response

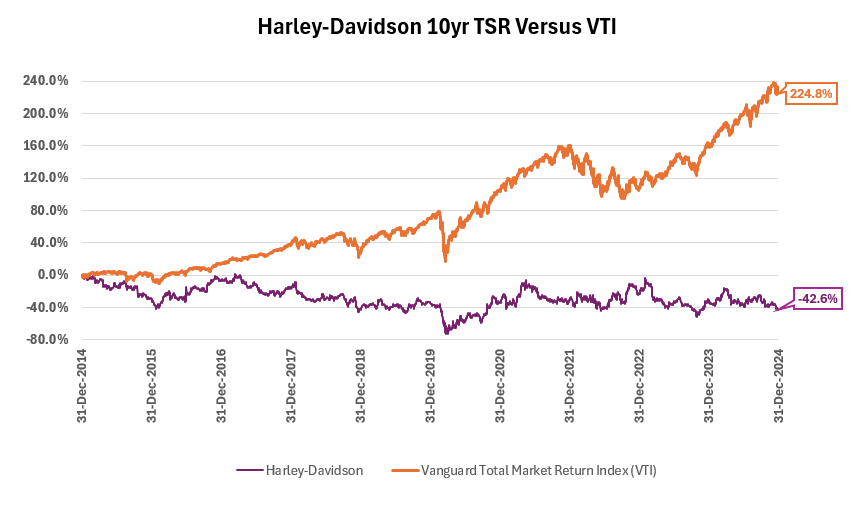

These trends have been apparent for many years now, yet it does not appear that Harley has adapted to a changing world. As a result, their share price has seen poor performance. As can be seen in the chart below, the TSR over the past decade is negative.

Figure II: Total Shareholder Return for HOG and Vanguard Total Stock Market Index (10yr)

Opposing Approaches

Another proxy advisory firm has recommended shareholders vote FOR all the Harley-Davidson nominees because, in their words, “the bigger picture is that the strategy introduced by Mr. Zeitz has had a positive impact on the trajectory of (the company), which had lost considerable ground when he took over as interim CEO.”⁷

Recommendations for Egan-Jones’ Wealth-Focused Policy are based only on protecting and enhancing investor wealth. Since a public company’s fiduciary duty is to generate returns for shareholders, and since the opposite has occurred over the last five years at Harley-Davidson, we do not believe Mr. Zeitz has had a positive impact on the company.

Further, we are generally not supportive of directors who oversee management during a period of underperformance. HOG has underperformed for years, and, as a result, we believe it is time for new directors in the boardroom.

Sources:

[1] Table 4 - Motorcycle Owners by Age in the United States for Selected Years, 1985-2003| Bureau of Transportation Statistics

[2] Today's Motorcyclists Revealed by Latest MIC Owner Survey

[3] Motorcycles registered in the United States, 2002–2023

[4] Is Harley-Davidson Heading for a Crash?

[5] GlobalMotorcycle Market Valuation to Reach $223 Billion By

[6] LiveWire| LiveWire Group, Inc. Reports 2023 Fourth Quarter and Full Year Financial Results

[7] https://www.jsonline.com/story/money/business/2025/05/06/harleys-proxy-fight-advisory-firm-sides-with-company-board/83471125007/