Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Survival of the Fittest

Overview

A primary job of sophisticated institutional investors and risk managers is predicting which entities will survive and thrive over time. In our view, there is a revolution occurring in which some legacy firms will become increasingly threatened.

Photo: BYD Yangwang U9 Electric Sports Car

Key Success Factors

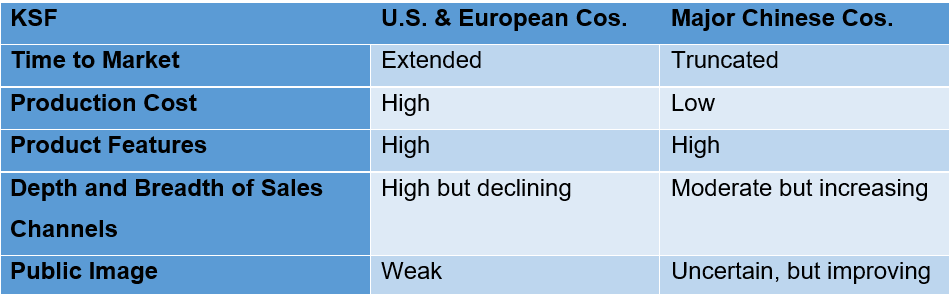

A reasonable framework for judging the likely success of a business is to determine the alignment of firms’ capabilities with market needs (i.e., the status of key success factors or KSFs). Below is a simplistic listing of those factors for the auto industry:

• Time to Market

• Production Cost

• Product Features

• Depth and Breadth of Sales Channels

• Public Image

A recent article from Reuters addresses these issues for the global auto industry¹, and the results were shocking. Below is our informal (albeit probably fairly accurate) assessment of the major producing firms; from the perspective of the U.S. and European manufacturers, the results should be a cause for concern. As can be seen, in nearly all of the KSFs, the Western-based firms have fallen short.

The Future

Now for the interesting part, which is predicting the future. As most seasoned managers know, changing the culture of a firm is extremely difficult, and the legacy firms are unlikely to be successful at doing so. Regarding the banning of electric vehicles (EVs) which have traditionally been the focus of most Chinese auto firms, we have several thoughts:

- Climate Concerns - Europe is wedded to climate concerns and therefore is unlikely to backtrack much on current regulations

- Improved Batteries - EVs appear to be addressing concerns regarding range and are becoming increasingly less expensive to produce (particularly as battery range improves and prices decline).

- Porous Barriers - tariffs often can be circumvented by establishing production in alternative locations.

- Expanded Product Offering - some manufacturers such as BYD are now making hybrids and therefore appear capable of competing regardless of customer or regulator whims.

Upshot

While it is nostalgic to think of the grand history of the legacy auto manufacturers, if our identification of the KSFs is accurate along with the assessment of those KSFs, then there might be some disruption in the future, provided the challengers have the staying power for the fight. Perhaps it is worthwhile to review the credit quality of challenger firms and to address the notion that a repeat of Evergrande is not in their future. (Some news articles questioned the extent of BYD’s accounts payable and their cash generation ability). Similarly, there has been some slippage in the financials of some of the smaller legacy firms.

Conclusion

The never-ending cycle of creative destruction appears to be alive and well and perhaps we have a front row seat for some massive upheavals over the next few years.