Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Mobility Mayhem

Mobility Mayhem

Machine Maturation

Domestically, the consumer sector is massive, comprising approximately 70% of the economy [1]. In the consumer sector, autos and housing are probably the two largest components. Autos we believe are on the verge of a major sea-change.

Most modern tanks and some troop carriers are equipped with systems that can automatically detect and destroy incoming rocket attacks. The systems often monitor the area around the tanks, and if a rocket is fired, they release a countermeasure to destroy the incoming rocket.

Figure I: Tank countermeasures

The sophistication and reaction time required are so demanding that humans cannot succeed, making sensors and software necessary. The takeaway is simple: machines can succeed in some areas where humans cannot.

Similarly, it is only a matter of time before self-driving autos become better and safer than human operators with lower auto insurance rates likely to follow over time. Here is an example of self-driving performance. We believe widespread adoption is likely to happen within years, rather than decades.

Manufacturing Mandate

In many industries, cost is king, whereby if one manufacturer has a significant cost advantage, it is merely a matter of time before that translates into greater market share which in turn further enhances cost advantages. We understand that Tesla (and perhaps BYD) has significant cost advantages in the production of electric vehicles over legacy manufacturers. The advantage starts with the massive die casting (i.e., the Giga Press) which simplifies and accelerates the production process by replacing many subcomponents with one massive component.

Killer Combination

Combining self-driving capabilities with production cost advantage has the potential to massively change the auto industry. Probably one of the first adopters will be Uber, Lyft, and similar firms, as they can provide safer, faster, and more profitable service. Ultimately, vehicles might be regularly stationed in key areas, like how 'for hire' scooters have become ubiquitous. Additionally, due to their safer track record, insurance costs for these vehicles are likely to be lower. Drunk driving incidents might also become a distant memory, as the vehicles will simply shut down if a driver insists on self-driving and drives erratically.

Possible Winners

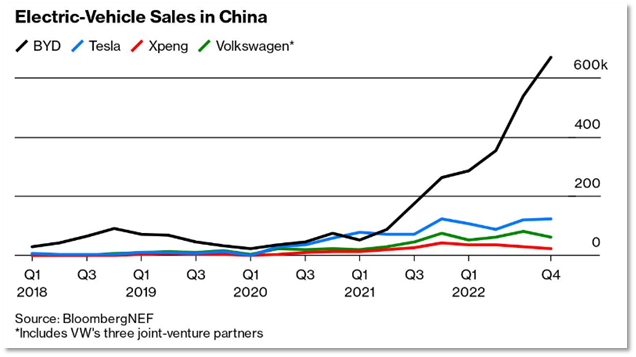

While predictions are always dicey, if our premise is valid, there are likely to be several winners. At the top of the list would probably be the leading firms in self-driving technology and auto manufacturing cost efficiency (possibly Tesla, BYD, and Waymo), suppliers (Panasonic), the ride-sharing firms (Uber and Lyft), and the suppliers to Uber and Lyft (various private firms have emerged). In the case of BYD, the graph below suggests that it is significantly outperforming Tesla and all other manufacturers in China.

Figure II: Electric-Vehicle Sales in China

Unrealized Losses

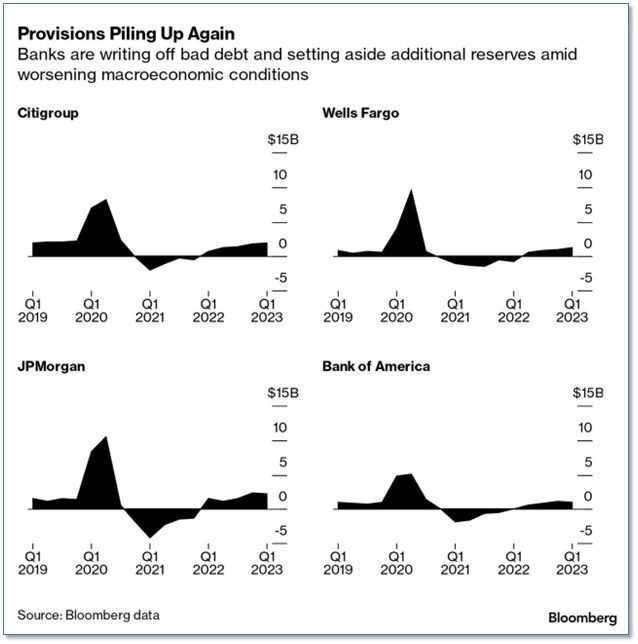

With the rise in interest rates and related weakness in the economy, major banks have increased reserves, but not nearly at the same pace as that experienced during COVID:

Figure III: Bank Reserves

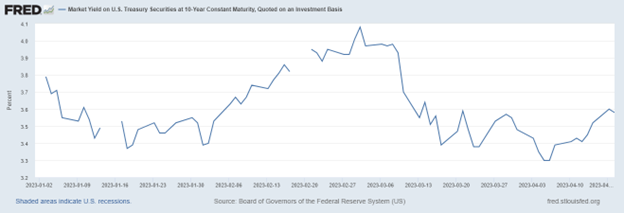

However, as can be seen below, yields for the 10-year Treasuries have moderated over the past months:

Figure IV: 10-year Treasury Market Yield

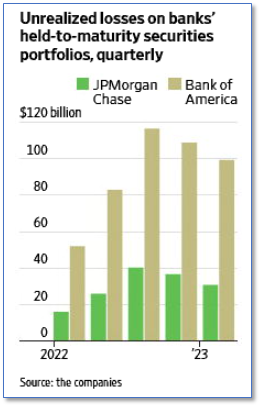

In response, as can be seen below, unrealized losses on held-to-maturity securities have also moderated:

Figure V: Unrealized Losses on Banks' Held to Maturity Securities Portfolios ($bn)

The issue for both central and non-central bankers is managing inflation on the one hand and credit losses on the other. Conveniently left out of the equation is fiscal policy, which is the elephant in the room, particularly with pending debt ceiling discussions.

____________________________________________

[1] Bureau of Economic Analysis