Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Split the Baby!

King Solomon’s Solution

How can one reconcile two irreconcilable views? The Biblical account of King Solomon covers such a case. The narrative describes two women who come to the King, each claiming that they are the mother of a baby boy. As a resolution, Solomon orders the baby to be cut in half, so that each woman can have part of him. One woman pleads with the King not to harm the child and instead give him to the other woman. This, of course, reveals the woman to be the child’s true mother. The true mother would never think that splitting the baby was an acceptable resolution to the dispute.

Splitting the baby is not the answer

Likewise, Egan-Jones does not believe that splitting our recommendations across management and the dissidents – splitting the baby – is a desirable solution when there is a contested election.

Shareholders of Brookdale Senior Living (BKD) have an opportunity to elect eight directors to the board on July 11th, 2025. Ortelius Advisors, a shareholder of BKD, has nominated six of their own nominees to the board. After reviewing the company’s financials, strategy, and execution on that strategy, we believe shareholders should vote FOR all six of Ortelius’s nominees.

While a peer proxy advisory firm has recommended that shareholders vote for just two of Ortelius’ nominees, we do not believe that such a recommendation – splitting the baby – is logical.

Brookdale’s Poor Financials

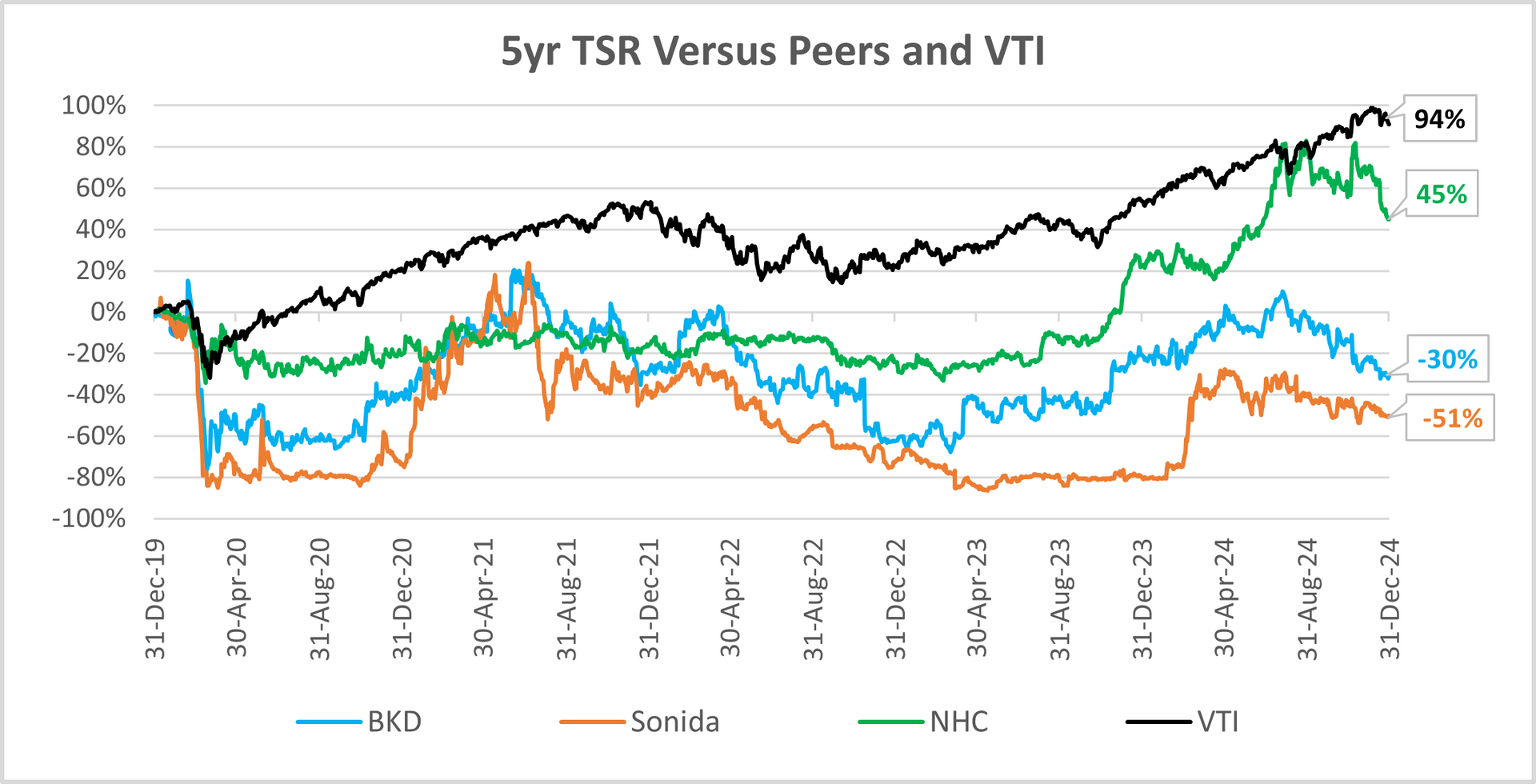

Brookdale Senior Living owns and operates hundreds of senior living communities across the America. The pandemic dealt a major blow to their firm. However, unlike other firms, BKD has been unable to recover to its pre-Covid stock price; BKD’s stock price was down 30% at the end of 2024 as compared to 5 years prior (see chart below).

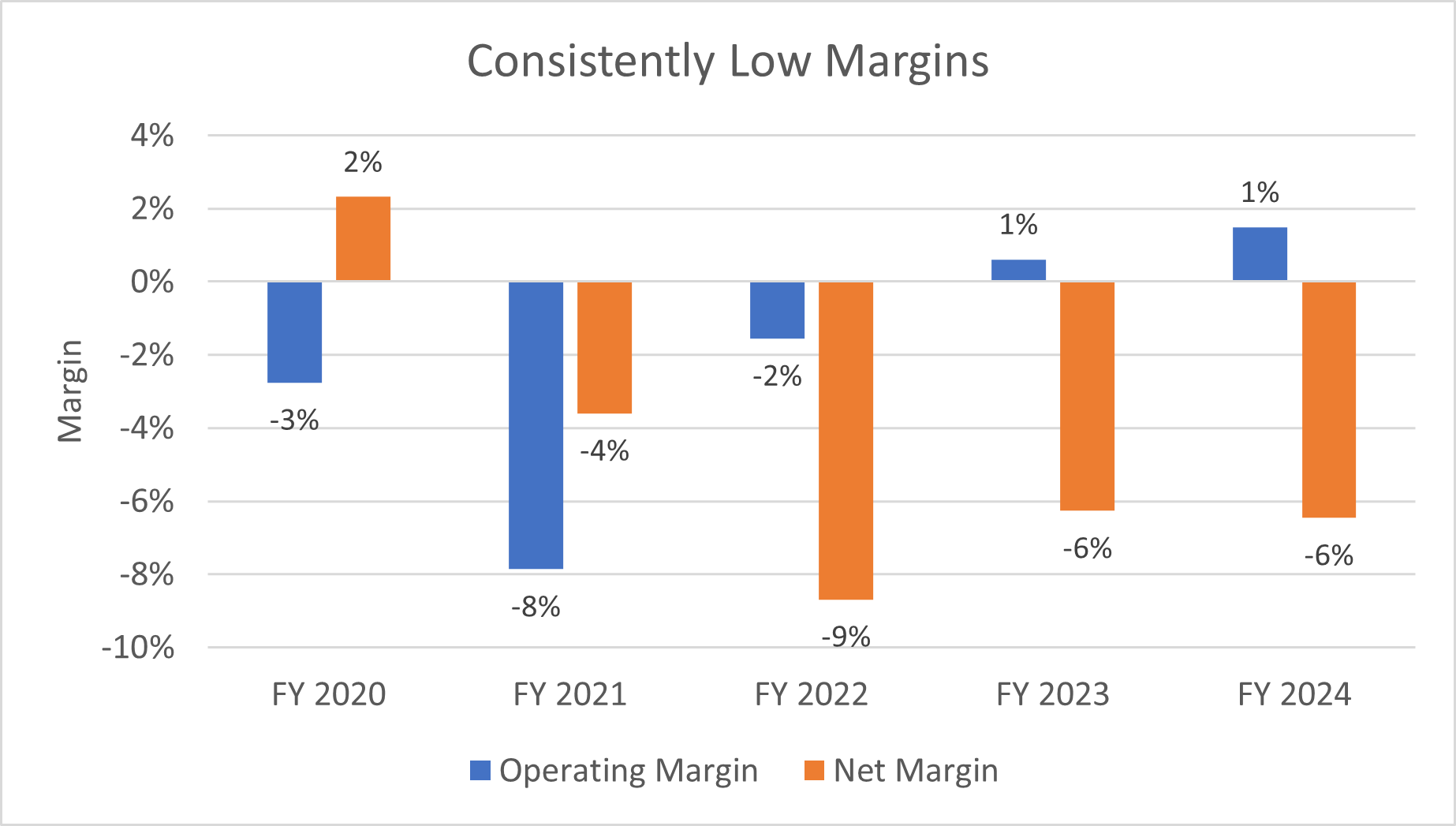

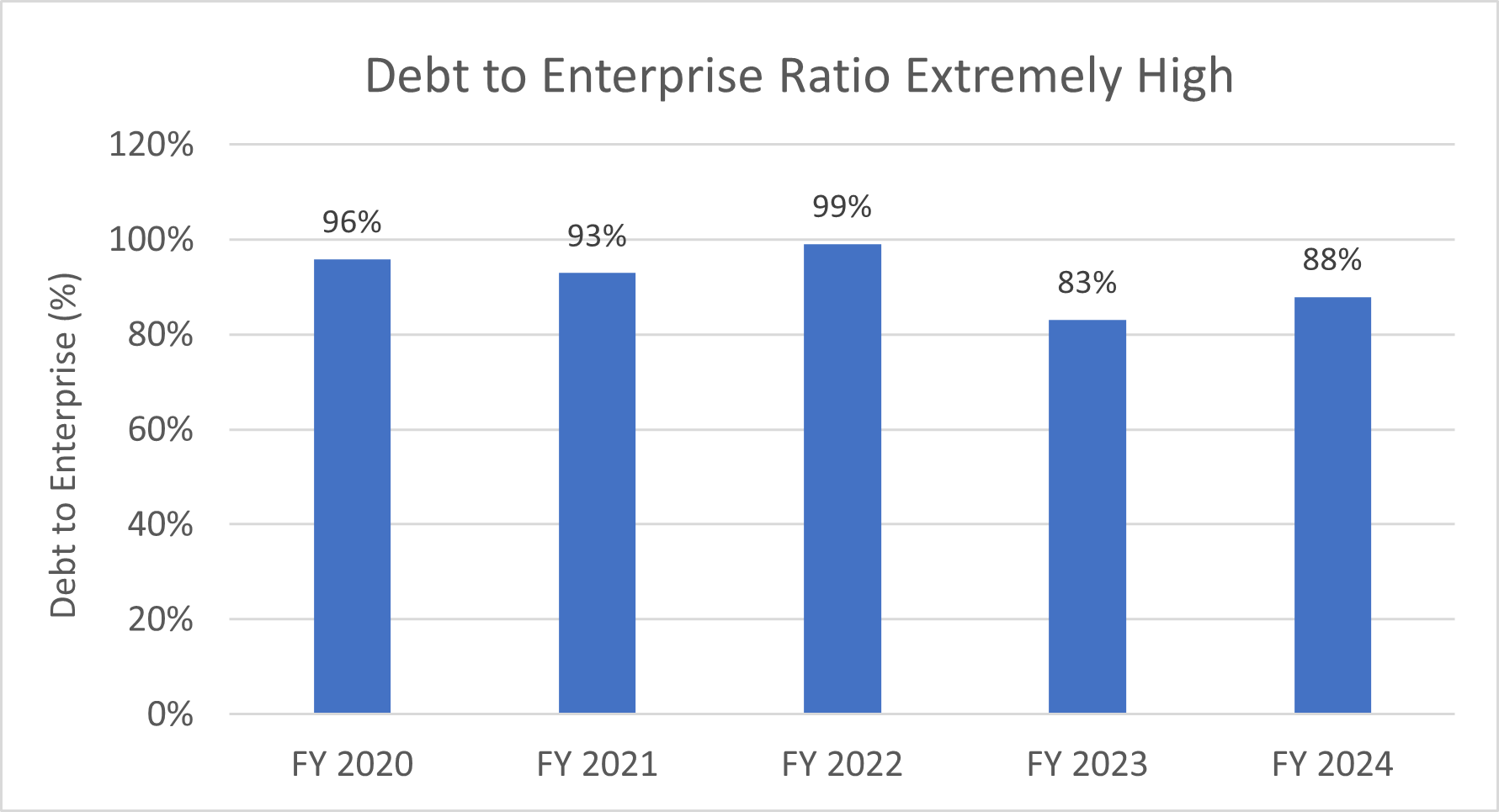

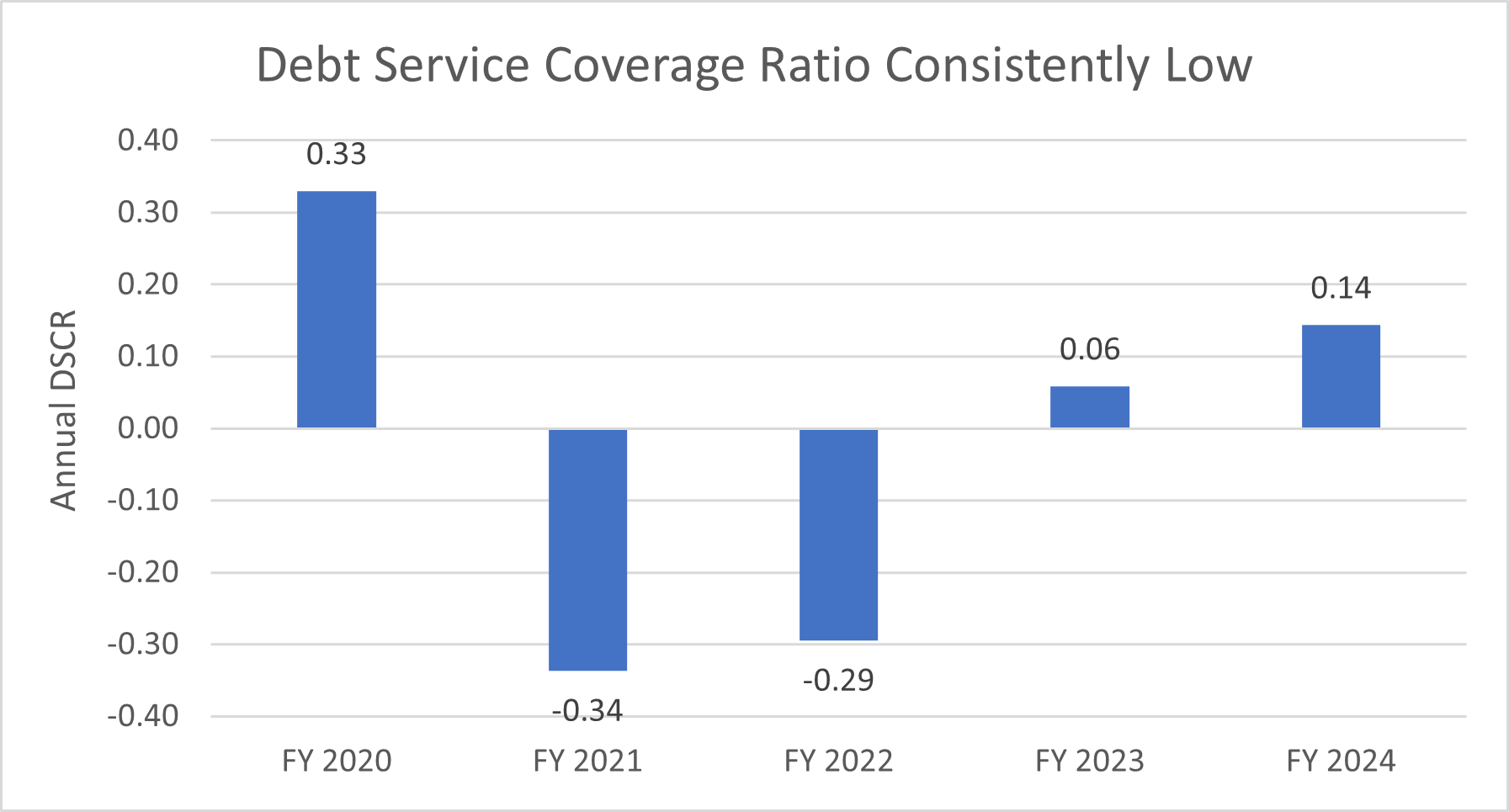

Additionally, the financials of the company are alarming. Operating margins have sat at 1% or less for the past five years, and the company is highly levered, with a debt-to-enterprise-value ratio that has averaged over 90% since 2020 and a DSCR below 1.0 over that same period.

The company is bleeding cash, which could accelerate should they face higher borrowing costs in future financing rounds.

A Choice in Strategy

The poor margins are driven by low occupancy rates at many of BKD’s facilities. While senior living community occupancy rates average approximately 86-89% nationwide, Brookdale’s average is 80% as of May 2025. Furthermore, approximately one-quarter of all BKD facilities have occupancy rates of less than 70%. These low occupancy rates are alarming, given that an occupancy rate of ~80% is generally needed to cover facilities’ fixed costs.

The company has extremely low liquidity and high debt obligations – cash is needed. The current management believes they will be able to grow their way out of their high debt obligations by continuing to focus on improving occupancy rates and therefore margins. However, the dissidents believe that a significant number of underperforming assets must be sold to avoid losses and have the added benefit of raising cash.

After reviewing available public information and engaging with both sides of this contest, we believe that the dissidents’ strategy is in the best interests of shareholders. Given that other senior housing facilities have recovered from the pandemic, we don’t believe that more time with the current strategy will fix the operational inefficiencies. In fact, it has the potential to make the cash position of the firm much worse. Instead, we agree with the dissidents that certain underperforming assets should be sold and cease to be a drain on the company’s resources.

Conclusion

Two very different strategies are being presented to shareholders at this year’s meeting: continue along the current path (with management) or sell off underperforming assets (with dissident nominees). Shareholders must decide which strategy has a better chance of protecting and enhancing their investment. Only one of these two strategies can be pursued, and Egan-Jones believes shareholders should vote FOR all six of Ortelius’s nominees.