Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Tariff Turmoil; Winners and Losers

Overview

The tariffs have massively changed the business environment, creating winners and losers in the process. This installment addresses probable outcomes over the next couple of quarters. The result of tariffs is likely to be a reduction in demand for many goods (because of the increased costs) which might be reflected in some weakness in GDP results. Conversely, employment levels may rise from the reshoring of production. Lastly, for low-skilled positions (e.g., construction, manufacturing, and selected services) until there is more widespread introduction of robots, self-driving, and other technologies, labor costs might spike because of the reshoring and a restriction on imported labor.

The Losers

While not yet fully appreciated, if the tariffs stand, there is likely to be a 20% to 50% increase in retail prices in many items to cover the tariffs. Given the tight margins for many, if the tariffs stand, the disruption is likely to be broad.

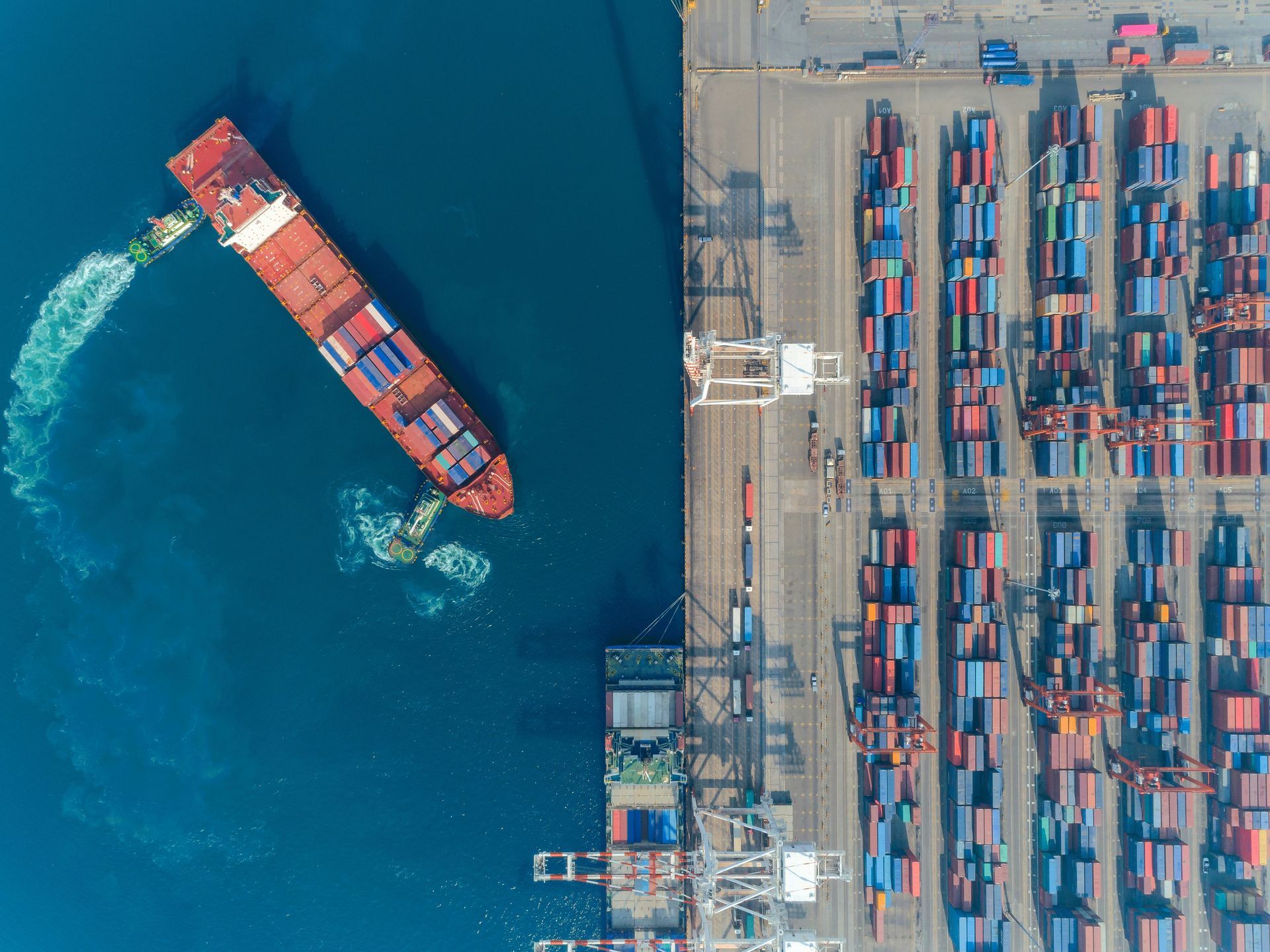

I. Shippers

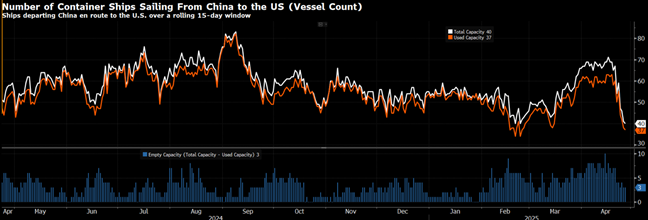

The reality is that with the massive increase in tariffs, particularly against China, the volume of shipping will decline. In fact, it already has as indicated by the chart below.

Figure I: Container Ships Sailing From China to the US (Source: Bloomberg)

Our view is that even if the tariff war ends tomorrow (it won’t), the slowdown in shipping will not end soon. Given that China appears reluctant to negotiate, a likely outcome is the shift of manufacturing to both the U.S. and to other countries. However, because it takes years to re-establish manufacturing operations, the upshot is likely to be pain for importers for some time.

II. The Retailers and Consumer Goods Firms

As of 2023, 60% of Walmart’s goods were imported from China:

“Walmart remains the biggest U.S. importer. About 60% of its imports, particularly items such as clothing, electronics and toys, are from China. In recent years, the retailer has diversified its supply chain to source from countries such as Vietnam, one of its top five suppliers, and India, reducing its exposure to China from 80% in 2018, according to a Reuters report in November 2023.”¹

Presumably, a good portion of the remainder comes from countries such as Vietnam, the Philippines, and Mexico, which are subjected to similar tariffs. Adding to the list of impacted firms are other retailers such as Target, Home Depot, and Best Buy, and consumer goods manufacturers such as Nike, Under Armour, and Samsung.

III. Autos

Approximately 50% of the vehicles purchased in the United States are imported:

“In 2024, Americans bought approximately 16 million cars, SUVs, and light trucks, and 50% of these vehicles were imports (8 million). Of the other 8 million vehicles assembled in America and not imported, the average domestic content is conservatively estimated at only 50%, and is likely closer to 40%.”²

With the current tariff levels, the cost of new vehicles is likely to rise from 12% to 25%, thereby placing significant pressure on demand. Of course, even if a vehicle is assembled domestically, the tariffs applied to parts can have significant impact on prices.

The Winners

Assuming the tariffs are not scaled back soon, the biggest winner is likely to be domestic manufacturing as it now has a relative cost advantage. The below headlines from the WSJ capture the theme:

“Tariffs Will Hammer Solo Stove. Its Amish-Made Rival Is Ready.”³

Of course, the administration’s focus on jobs helps clarify the plan: there will be short-term hardship due to increased prices, but a longer-term benefit with increased jobs. The shift aims to improve the country’s balance of payments, manufacturing capabilities, and reduce the perceived transfer of wealth and technology out of the country. The counterargument is being expressed by a slew of full and part-time economists expressing concerns about a potential return of the miserable conditions stemming from the Smoot-Hawley Tariff Act.

“The Smoot-Hawley Tariff Act, signed into law in 1930, was a U.S. law that raised tariffs on a wide range of imported goods. It was intended to protect domestic industries, particularly agriculture, from foreign competition but resulted in retaliatory tariffs from other countries, ultimately exacerbating the Great Depression.”⁴

Time will tell whether the current approach is best, but there is little doubt that the environment has massively changed.

Sources

[1]https://www.reuters.com/business/retail-consumer/walmart-best-buy-nikes-major-supply-hubs-asia-2025-04-03/

[2]https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-adjusts-imports-of-automobiles-and-automobile-parts-into-the-united-states/

[3]https://www.wsj.com/business/retail/solo-stove-breeo-fire-pits-trump-tariffs-8aedca80

[4]Google AI Overview: Smoot Hawley Tariff Act