Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

The “BIG” One

I. The “BIG” One

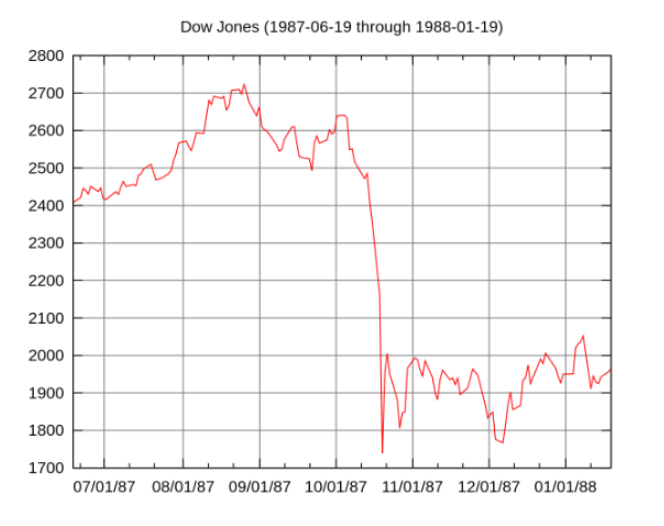

Perhaps the most daunting risk facing all institutional investors is a massive collapse in financial markets. The below chart is troubling as the 10-year yield continues to advance despite the easing of inflation; during the Black Monday crash, the Dow lost 27% over a few days.

Figure I: 10-Year Yield

Figure II: Black Monday Dow Jones [1]

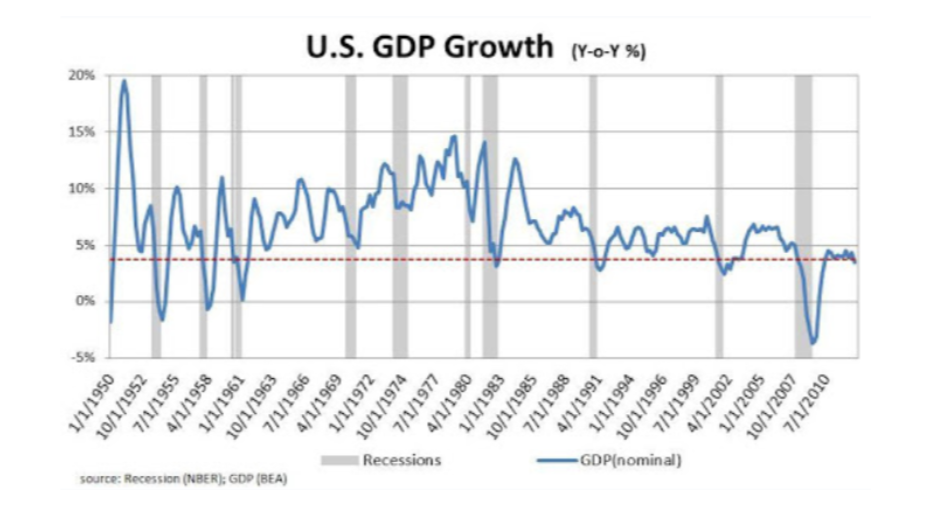

The rather regular boom/bust pattern has been the norm as can be seen below. In fact, the swings were even greater prior to the arrival of the late, great economist Maynard Keynes, who popularized Keynesian economics. The issue at hand is whether:

(i) the Fed will continue with interest rate hikes despite inflation cooling,

(ii) the 10-year will continue to rise despite inflation cooling and Fed interest rate policy, and

(iii) if the 10-year continues to rise, whether the highly indebted governments can or will help.

Figure III: U.S. GDP Growth

Causing angst among many investors is the rise in long-term rates (see Figure I above) despite the decline in inflation and money supply (as represented by Figure IV below).

Figure IV: Money Supply

Rising 10-year yields despite M2 declines may be irregular, though perhaps it indicates the market’s concern with fiscal debt. Dominant buyers of treasuries (i.e., the central banks) are liquidating holdings when supply of treasuries (i.e., treasury departments) are issuing more. The valuation of nearly all medium and long duration assets will be under increased pressure thereby feeding into a potential “Doom Loop.”

We have been here before, just in a different form. As of several years ago, Italy and Spain faced high funding costs and elevated debt levels. The prevalent concern was that the countries would simply be unable to service their debt despite taxation and austerity measures. Just when it appeared they were slipping under the waves, Super Mario (i.e., Mario Draghi) announce the ECB would do whatever it took to save the countries. Shortly, thereafter, funding costs returned to prior levels and fears eased.

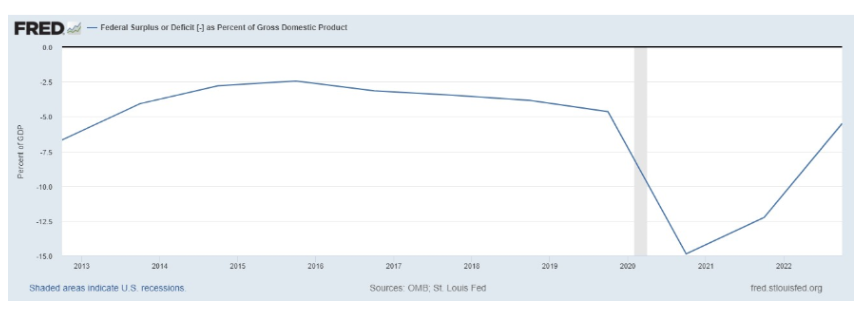

The issue is whether the US Treasuries will follow a similar path, and how long it might take. Adding to the concerns is the fiscal deficit, which might gap out if we were to enter a recession.

Figure V: Federal Surplus or Deficit as % of GDP

II. Washington Woes

Kevin McCarthy’s ousting suggests that Washington is likely to remain polarized for the foreseeable future. His removal appears to be caused by dis-satisfaction among a small faction regarding spending. Meanwhile, presidential politics are likely to get more interesting with the announcement of Robert Kennedy Junior’s run as an independent. Many assume that Kennedy will hold more appeal to the Democratic base, but like Trump, he is anti-establishment and it remains to be seen how many states will place his name on the ballot. Regardless, polarization is likely to remain.