Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Underperformance at Under Armour: A Case for Director Accountability

Key Takeaway

Shareholders should hold the directors of Under Armour accountable for the severe underperformance of the company over the past decade and AGAINST votes for long-standing directors Coltharp, Devard, El-Erian, Gibbs, Olson, and Plank.

(Some proxy ballots do not provide an option to vote “Against.” In those cases, Egan-Jones recommends voting “Withhold.”)

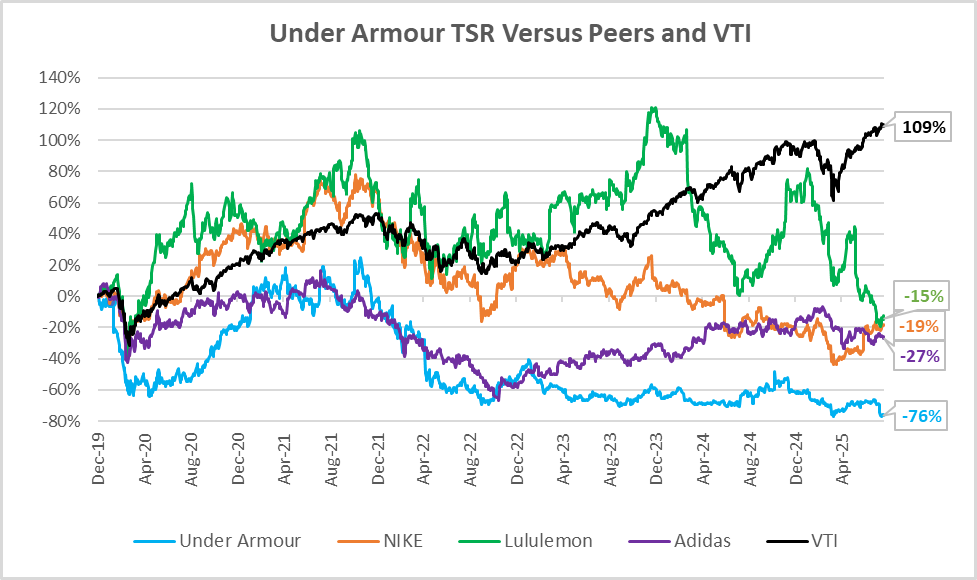

Under Armour has consistently underperformed compared to its peers and the total market, as illustrated in the chart below, which shows the total shareholder return (TSR) of Under Armour and its peers since the beginning of 2020 (pre-pandemic).

Introduction

On September 3, 2025, shareholders of Under Armour, Inc. (NYSE: UAA) will have a chance to vote at the company’s annual meeting. Shareholders should pay close attention to the eleven directors up for reelection at this year’s meeting. While Robert J. Sweeney, Dawn Fitzpatrick, and Eugene Smith are all recent additions to the board (2025), and Patrick Whitesell and Carolyn Everson have only been on the board since 2023, the remaining directors have been on the board for a significant period and have overseen a loss of shareholder value.

The stock price today sits only 33% higher than when the company first went public in 2005. The share price reached its peak in 2015, rising to approximately $50/share. Today, the share price sits at just $5/share.

Because the board has failed to deliver sufficient returns to shareholders, we recommend shareholders vote AGAINST directors Coltharp, Devard, El-Erian, Gibbs, Olson, and Plank.

The Beginnings

Under Armour was founded in 1995, initially focusing on college football teams, a niche that lacked sufficient attention from larger rivals Nike and Adidas.

Under Armour’s early success came from their unique moisture-wicking technology. Though standard for sportswear today, in the 1990s and early 2000s, this technology was popularized by Under Armour.

Through the early 2010s, the brand secured high-profile endorsements from figures such as Tom Brady, Steph Curry, and Dwayne “The Rock” Johnson in an effort to generate a recognizable brand associated with high performance.

The Shortcomings

Inconsistent Market Strategy

The mid-2010s proved to be the beginning of a challenging decade for Under Armour. In 2016, Under Armour signed a deal with the MLB to supply the league’s uniforms, only to back out of the deal two years later amid poor financial performance.

In 2017, Under Armour signed a 15-year, $280 million deal with UCLA to be the school's apparel sponsor, only to terminate the deal and pay a $67.5 million settlement in 2020 amid the COVID lockdown.

While the decisions to back out of the deals may have made financial sense at the time, the deals were likely adopted without sufficient consideration for sales challenges.

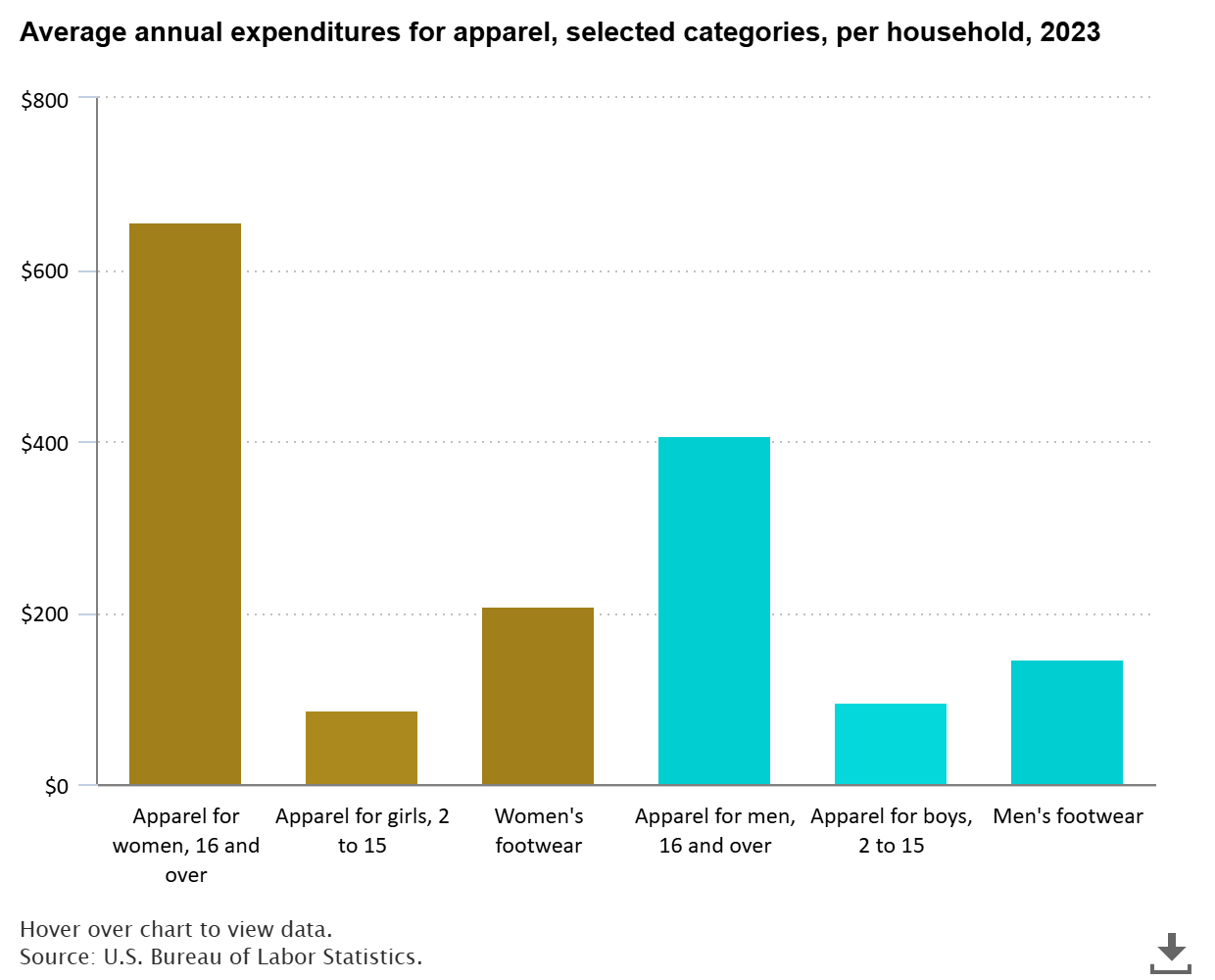

Appeal to Women

According to the Bureau of Labor Statistics (see chart below), women’s clothing (excluding footwear) accounts for 60% of apparel spending. However, at Under Armour, women account for less than a quarter of revenue. Under Armour has failed to appeal to both sexes, unlike counterparts Nike and Adidas.

Sports Apparel

Two key segments of sports clothing are sports apparel, often referred to as “athleisure”, and activewear. Sports apparel is fitness-inspired, but is often designed for use off the field, track etc. Activewear is designed specifically for use in exercise.

Under Armour made early gains in the activewear segment, but failed to gain market share in the apparel segment, which has been highly detrimental to shareholders.

Apparel is a critical segment for three reasons. First, there is a much broader market for apparel than there is for activewear. Only a subsegment of the population regularly plays sports or exercises and thus constitutes an appealing demographic for activewear. However, virtually the entire population is apt to purchase apparel for use in a casual setting.

Second, there is a much deeper market for apparel than there is for activewear. One may not exercise daily but people tend to wear casual clothing daily. Furthermore, apparel offers more variety than activewear, which tends to be more utilitarian, by definition. More variety means more sales opportunities for an apparel brand.

Lastly, for a subsegment of the apparel market, customers have lower price sensitivity. Stated otherwise, brands can charge high prices irrespective of the cost of goods. Low price sensitivity among some apparel consumers is perhaps best demonstrated in the footwear segment, where avid buyers, known as “sneakerheads,” spend considerable sums. Lululemon (NASDAQ: LULU) has perhaps most effectively captured apparel consumers with low price sensitivity across products other than footwear.

Footwear

Footwear tends to wear down more quickly and noticeably than other products (e.g., T-shirts). Thus, consumers tend to purchase more frequently. Footwear has the added benefit of higher prices than other sportswear products.

However, Under Armour footwear experienced a 13% decline in revenue from 2024 to 2025.

Digital technology

In an effort to gain more insight into customers and develop deeper relationships with them, Under Armour acquired MyFitnessPal, Endomondo, and MapMyFitness for a total of $710 million in hard costs but divested each after failing to sufficiently capitalize on the technology.

Leadership Challenges

Finally, Under Armour has struggled in recent years with stable leadership; the firm has undergone four CEO transitions between 2020 and 2024.

Conclusion

The clothing business is particularly challenging. Brands with more storied pasts than Under Armour such as Brooks Brothers, Gap, and J Crew have faced massive challenges or bankruptcy amid changing consumer behavior. Competitive moats for clothing brands are relatively narrow. It is relatively easy for competitors to copy each other’s design. Further, consumers tend to lack loyalty to one brand as fashions change.

Regardless of challenges in differentiating products, margins for all but the dominant players are relatively thin. Brands must spend massive sums on marketing and celebrity endorsements to appeal to customers. Only brands with sufficient capital, most often provided by either high profits or an outside investor, can afford the massive sums required for the most desirable sponsorships such as Major League Baseball. Under Armour has unfortunately fallen below the profit threshold and lacks a motivated investor to spur marketing spend.

Despite these challenges, a company has a duty to deliver value to its shareholders. The board of directors is responsible for holding management accountable and shareholders are responsible for holding the board of directors accountable. NYSE:UAA has failed to deliver value. Therefore, under all its policies, Egan-Jones recommends shareholders vote AGAINST six Under Armour board members at this year’s shareholder meeting.