Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

What the Market is Missing

Overview

U.S. Treasuries are the benchmark for pricing credit in most domestic markets and many international markets. The reason is that Treasuries are considered risk-free and therefore are a reasonable starting point. However, that reasoning has been called into question recently. The purpose of this installment is to address whether there is real risk in the repayment of Treasuries.

Background

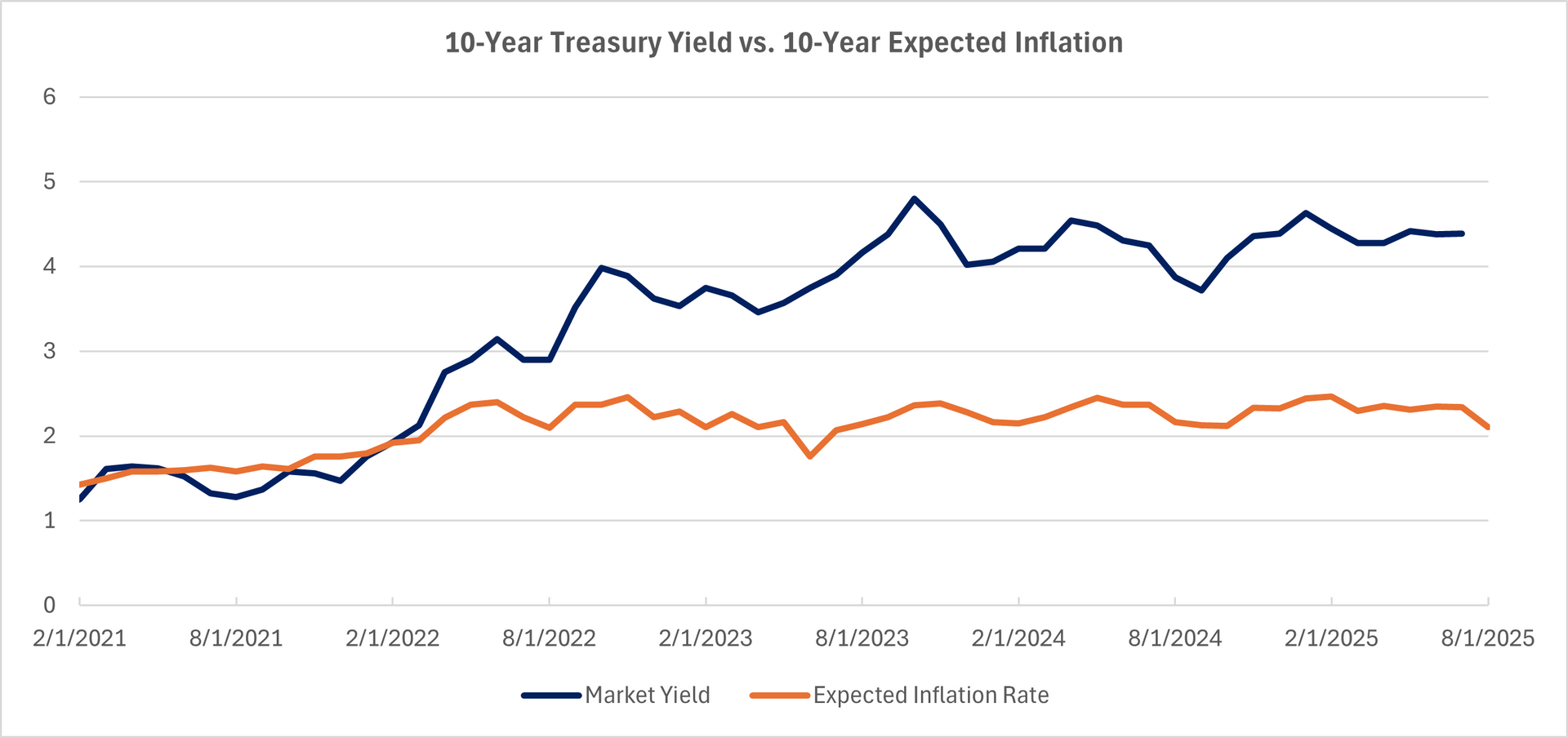

Treasuries historically have provided yields near the expected rate of inflation, currently near 423 bps as shown above. However, the 10-year Treasuries are yielding 200 bps more than the 233 bps 10-year inflation expectations. Furthermore, as indicated in the treasury graph above, the yield has steadily increased over the past 5 years. Obviously, the relationship has broken down, suggesting that something bigger is at play.

The Elephant in the Room

There are two plausible reasons for the breakdown, and perhaps both carry with them some degree of truth, at least regarding market concerns:

Reduced Demand - Because some major holders of U.S. Treasuries, such as the Bank of China and others, are slowing their purchases, the yields required in the market have risen.

Credit Quality Concerns – There is high and increasing debt relative to GDP. Regardless of political party changes, there has not been a meaningful reduction in spending levels.

Our Premise

In our opinion, the concerns are misplaced and that for the foreseeable future, the obligations will be paid in full and on time.

(This opinion is from the writers of this report, which are separate from the Ratings Group.)

Our Reasoning

There are two components to our reasoning:

A. Prior Actions of the Fed - the Fed has shown its willingness to purchase securities both in the 2008 Credit Crisis and in the more recent COVID crisis.

B. Current Administration Focus – the current administration appears to be focused on reducing expenses and increasing revenues. On the revenue side, tariffs represent the most significant action, in addition to the sale of Fannie Mae and Freddie Mac and the recently announced revenue deal with Nvidia. Furthermore, because of the tariffs, there is a greater incentive to manufacture in America. On the expense reduction side, the cuts in USAID, the cuts in staffing, and other related actions should help in reducing deficits.

Prognosis

If we are correct in our assumption that U.S. Treasuries are “money good,” then the question turns to how the Fed and the current administration will react over time. Our view is that actions are already underway whereby the current administration will continue its pressure on the Fed to reduce rates, and if that is not successful, will pressure the Fed to close the gap via some limited Quantitative Easing.

Conclusion

Periodically, the market misjudges future conditions. Perhaps this is one such time.