Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Dynavax: Your New Empire?

Your New Empire?

2025 marks the 20-year anniversary of Star Wars: Revenge of the Sith, a story of the creation of the Galactic Empire. While Darth Vader (Anikan) describes his empire as a vessel for peace, freedom, justice, and security, his former master, Obi-Wan, sees it as a corruption of a once-thriving polity and of his friend. Obi-Wan’s disgust is revealed in asking with exasperation, “your new empire?”

The concern is one shared by many investors, who fear executives destroy shareholder value by using cash to build their own empire instead of returning it to their investors.

Overview

Dynavax, a commercial-stage biopharmaceutical company which creates vaccines and formulas to increase vaccine effectiveness, is currently undergoing a proxy contest. The salient question is if Dynavax ought to (A) run a high-margin business focused on marketing and sales of its existing products and return money to shareholders in the form of share repurchases and dividends or (B) seek additional growth opportunities in new products and services. The dissident, Deep Track Capital, supports strategy (A) while management supports strategy (B).

The key question to answer for investors is which path yields the highest net present value.

Playing the high-risk high-return game

Once a biomedical product such as a vaccine or drug are accepted by the FDA and non-US regulatory agencies, margins are typically high and returns are predictable. Usually, the treatment owner has a patent and a predictable pipeline of customers. Save government intervention, it is reasonable to expect consumers and their insurers will continue to pay for the biomedical product even in a financial downturn. The problem is producing a viable product.

To achieve those high, stable returns a biopharmaceutical company must go through long, costly, and uncertain research and testing regimen which may result in a sunk investment. The best corollary is the venture capital (VC) space; most VC-backed startups fail but the hope is that one winner will make up for many losers.

Formula for success

The challenge for investors is identifying those biopharmaceutical firms which have a better chance at producing successful products. To be successful investing in novel biopharmaceutical products, firms must be able to achieve the following tasks …

- Identify markets for a new product (this could be a small population willing to pay large amounts for the drug or vaccine or a large population willing to pay smaller amounts)

- Identify a technology to address the market need (e.g. mRNA vaccines)

- Convert that technology into a viable candidate for regulatory approval

- Pass rigorous regulatory approval regimens

- Produce the product efficiently

- Run an effective sales and marketing campaign

Of course, a biopharmaceutical firm may maintain expertise in only a subset of these tasks and seek others’ expertise to add value in the other tasks.

Sidebar: Duty of Corporations

Speaking from a classical understanding of economics, it is not the duty of a corporation to create new products and services for their own sake. Their duty is to maximize returns to shareholders, which in turn enables shareholders to invest in more productive ventures which do improve products and services.

What is adding value?

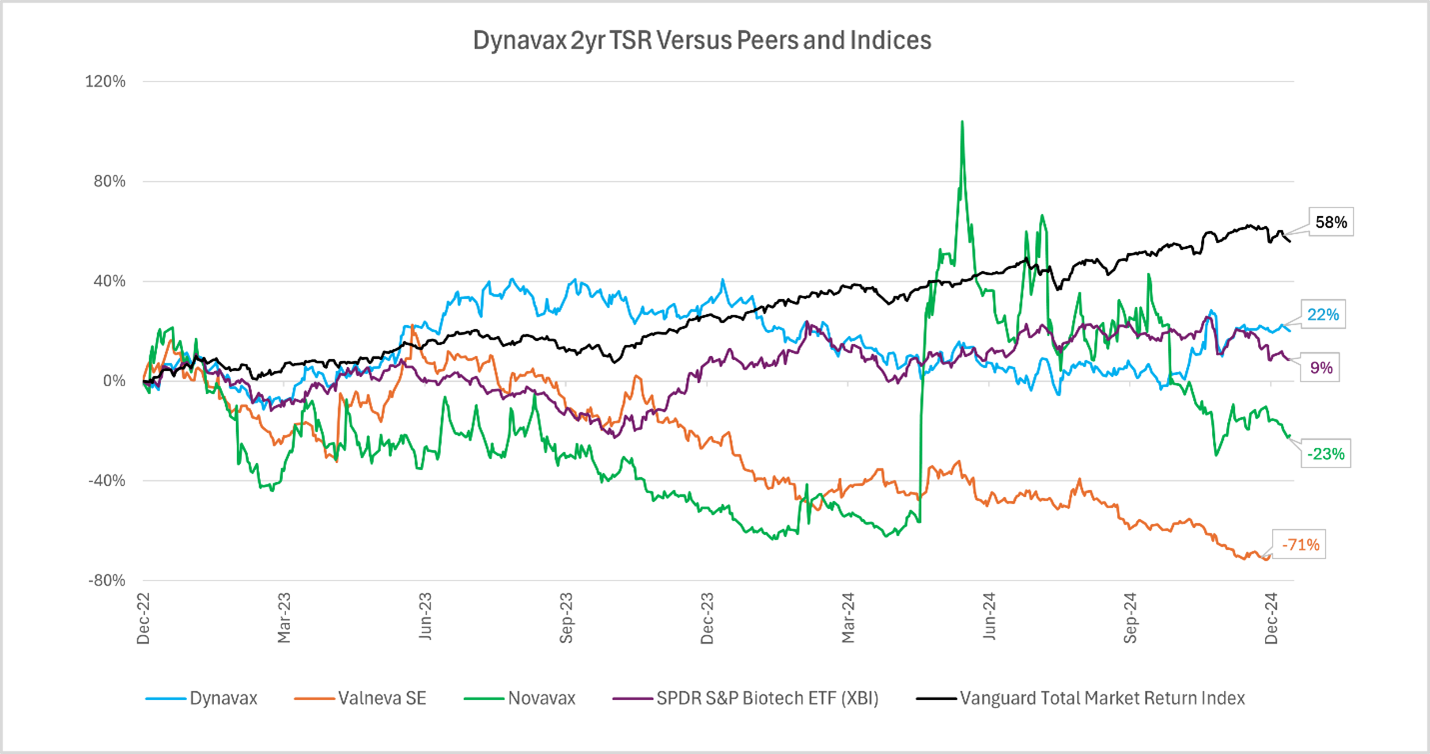

Deep Track Capital and the Dynavax board appear to agree that Dynavax has created tremendous shareholder value through producing and marketing its Hepatitis B Vaccine and CpG 1018 adjuvant (see TSR chart below).

The relevant question is if Dynavax would have a higher net present value if they (A) focus on extracting returns from existing products or(B) seek to develop new products. By definition, (B) puts capital at risk that might not yield a return. However, Egan-Jones believes there hasn’t been sufficient evidence presented demonstrating management’s inability to execute on (B) developing new products.

Recommendations from Egan-Jones

In this case, Egan-Jones supports Dynavax’s board nominees due to the firm’s strong financial performance, ability to profit from their CpG 1018 adjuvant through the Covid pandemic, and attractive pipeline. In this case, we don’t believe Dynavax should be accused of creating an empire at the expense of shareholders, though investors ought to remain wary of the temptation across public companies.