Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

Goldilocks and the Gorillas

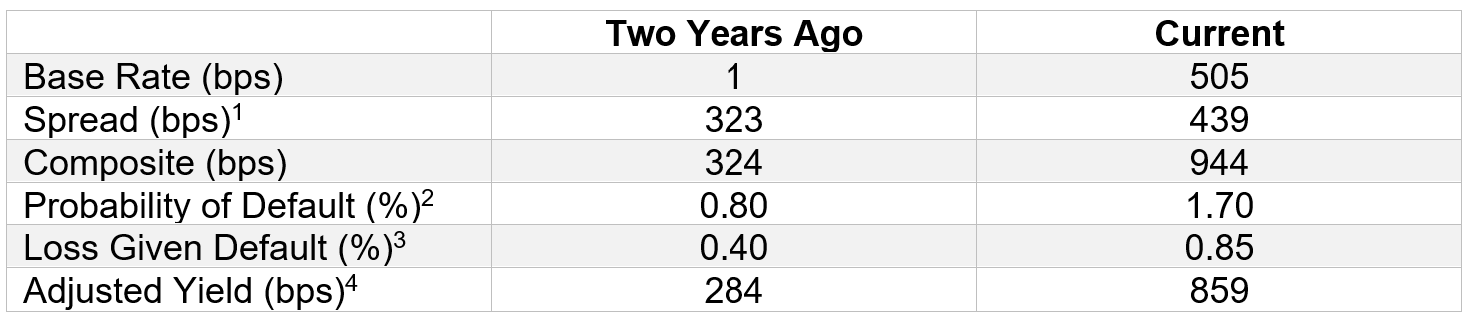

The tale of Goldilocks is well-known; it basically involves the protagonist, Goldilocks, finding the ideal temperature for a satisfying meal. Using Goldilocks as a metaphor, conditions in the private debt space are ideal - satisfying returns are paid in base rates and spreads, leverage is low, and defaults are moderate. Given low leverage and the ample private equity dry powder, it is likely that recovery rates will be attractive. Below is a summary of prior and current conditions.

Figure I: Private Debt Condition Changes

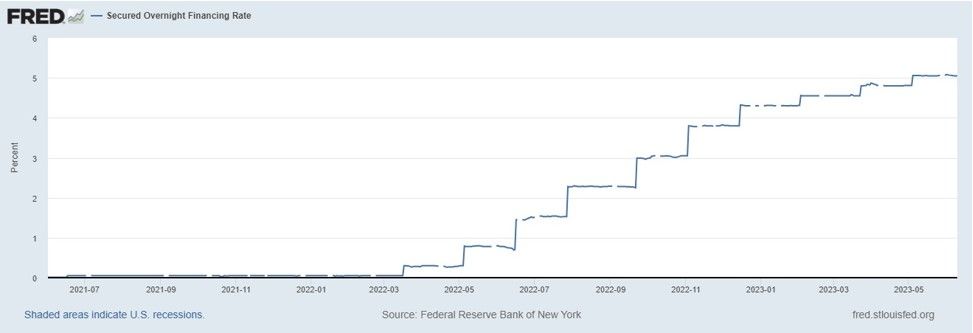

Figure II: Secured Overnight Financing Rate (%)

Figure III: ICE BofA US High Yield Index Option-Adjusted Spread (%)

A relevant question is why conditions allow such propitious conditions to exist for private debt. Our view is that one is temporal and the other structural.

On the temporal side, the structured finance markets have been on pause for the better part of 12 months. These fair-weather friends (particularly the “AAA” buyers) have taken leave upon the central banks stoking up their war on inflation.

On the structural side is the awakening of the banks and perhaps more importantly, the regulators to the renewed importance of asset/ liability management. Whether intentional or not, the banks were encouraged to buy “low risk” assets in the form of treasuries and agency-backed securities. While the assets were low risk from a credit perspective, they were massively risky from an interest rate perspective. The unprecedented rise of Fed funds rates and electronically driven deposits shifts led to a new paradigm for many banks. The new norm appears to be a “thin bank” whereby the traditional lending functions are limited in favor of a simple deposit and trust services function.

So where is the Nobel-winning economist Eugene Fama, who claimed that markets are efficient and that all discrepancies are arbitraged away? In our opinion, this theory, like many academic teachings, has merits but often breaks down in practice. As is often the case, technology has reduced deposit duration. Furthermore, regulators are forced to react and pressure banks to better match the duration of assets (i.e., loans and securities) to the now much shorter duration of liabilities (i.e., deposits).

Back to our headline, given the size of the two gorillas, (i.e., the CLOs and the banks) the private debt providers are enjoying highly favorable or “goldilocks” conditions. As usual, there is a rub, and that is while market conditions are propitious, many investors have had difficulty raising capital. To support raising capital, many clients have used structured notes which benefit from diversification and a deep demand base.

____________________________________________

[3] ICE BofA High Yield Option-Adjusted Spread (from FRED). Note, the Private Debt spreads are typically greater than HY.

[4]https://www.forbes.com/sites/mayrarodriguezvalladares/2022/09/26/probability-of-default-is-rising-for-high-yield-bonds-and-leveraged-loans/?sh=494d6bd9648f

[5] Estimated at 50%

[6] Composite yield – (Probability of DefaultxLoss Given Default)