Newsroom

Explore our newsroom for our weekly wreck, press releases, and trending topics.

The Widow(er) Maker

In finance, the definition of a widow(er) maker is a trade which appears to be highly attractive, but for various reasons, turns out to be a major loser. Short sellers are particularly prone to this situation whereby all the signs indicate that a particular stock should collapse and yet it does not. Perhaps the most recent example was GameStop, which rallied on the back of retail traders who sensed the opportunity for a short squeeze when approximately 140 percent of GameStop's public float had been sold short. The squeeze occurred when short sellers had to post additional margin as the stock gained despite the company’s poor performance.

Perhaps a parallel exists in the fixed income markets in China. China appears to be suffering a collapse in exports perhaps because of adjustments in supply lines and restrictions on various trade practices.

Dollar value of China's exports plunged 12.4% in June from a year ago, a far bigger drop than expectations for a 9.5% decline in a Reuters poll and the 7.5% annual decline in May. Imports declined 6.8%, in June from a year ago, also worse than expectations for a 4% decline and the 4.5% annual decline in May. [3]

Another concern is that China has spent massively to build out its infrastructure over recent decades and has succeeded in developing an impressive transportation system.

However, issues may be temporarily hidden because of the method in which funding is derived. Regional governments often used off-balance-sheet financing for the projects. The system works well until it doesn’t; that is, the debt is listed at face value and problems are not realized until payments are not made. Further, the cost of maintenance and repairs to the infrastructure may be substantial.

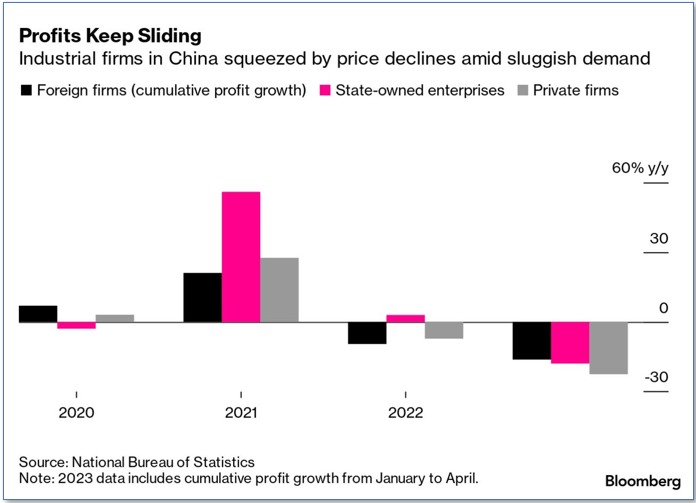

Another indication is the slide in profitability:

Figure I: Cumulative profit growth, China

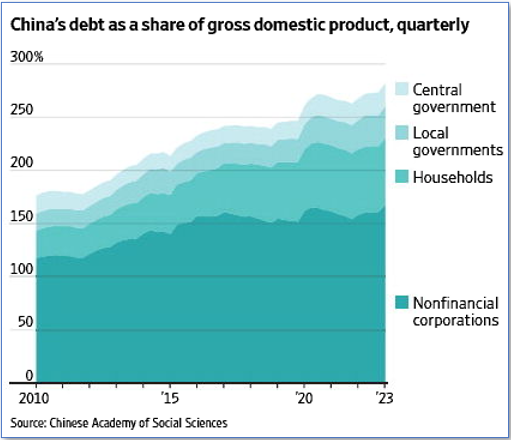

Complicating matters is the high level of indebtedness:

Figure II: China's debt to GDP ratio

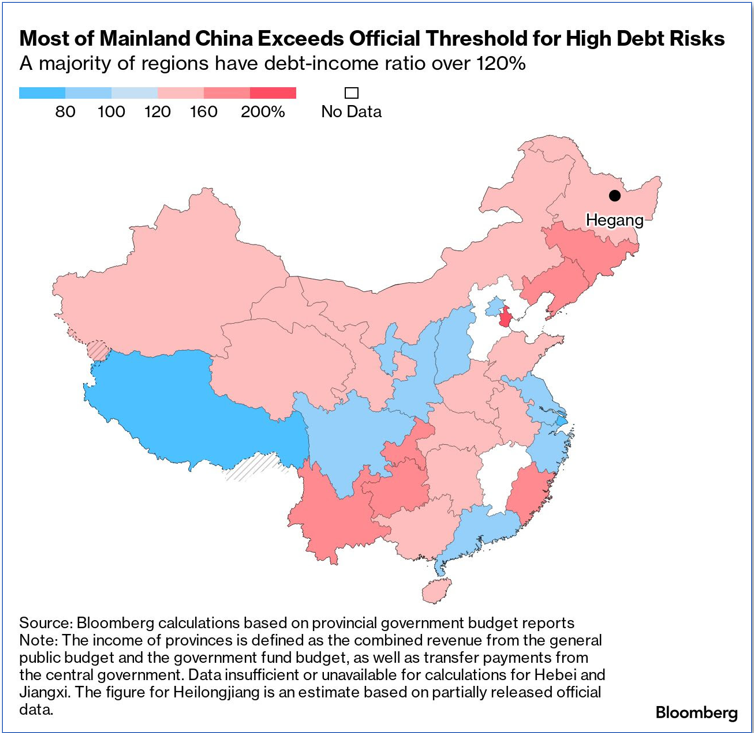

Regarding local governments, unfortunately, many regions are at the high end of leverage as defined in the below graph, making it difficult to sustain additional borrowing.

Figure III: Provincial debt-income ratio

Adding to the woes is the high leverage of many property developers, which have been stressed for the past several years. For many in China, the purchase of flats was considered a safe investment. A small down payment and a promise to make a series of monthly payments has been the pathway to a secure financial future for many. However, problems arose when consumers discovered that ghost towns were being built and that the developers lacked the funds to complete the projects. Recent indications of the extent of the problem are the following headlines:

“A Chinese Builder Halts All Offshore Debt Payment on Property Market Weakness”[4]

“Two More China Builders Say They Can’t Meet Debt Obligations; Central China, Leading Holdings fail to make bond payments; Debt delinquencies mount as market awaits fresh stimulus”[5]

Adding to the misery are threats of an invasion of Taiwan, the trend of Western countries to push the sourcing of supplies and production to less combative nations such as Mexico, Vietnam, and the Philippines.

Regarding recent comparisons, economist Richard Koo has made some interesting studies of Japan’s lost decade calling it a “balance sheet recession” claiming that a simple cut in interest rates by the central bank will not fix the problem as many households and businesses deemed their debt levels as too high and therefore had little interest in taking on additional debt regardless of the cost of funds.[6] If both individuals and households are unwilling to provide marginal demand for growth, then it is probably incumbent upon the central government to do so.

Returning to the “Widow(er) Maker” theme, the central government has massive power to manage the economy, particularly in a highly controlled country such as China. However, for those predicting Armageddon, we urge caution. For starters, China is centrally controlled with the central government having massive control over its population via social scoring, control of most economic activities, and a respectable foreign reserve balance. Hence, the normal catalysts for credit concerns are lacking.

Perhaps the most likely course is a muddling through over the next several years and hopefully a tempering of war talk.

Sources

[1] Data Source: National Association of Insurance Commissioners, by permission. The NAIC does not endorse any analysis or conclusions based upon the use of its data. Market share determined by direct written premiums.

[2] The analysis of the NAIC data by Egan-Jones has been validated by RiskSpan, Inc.